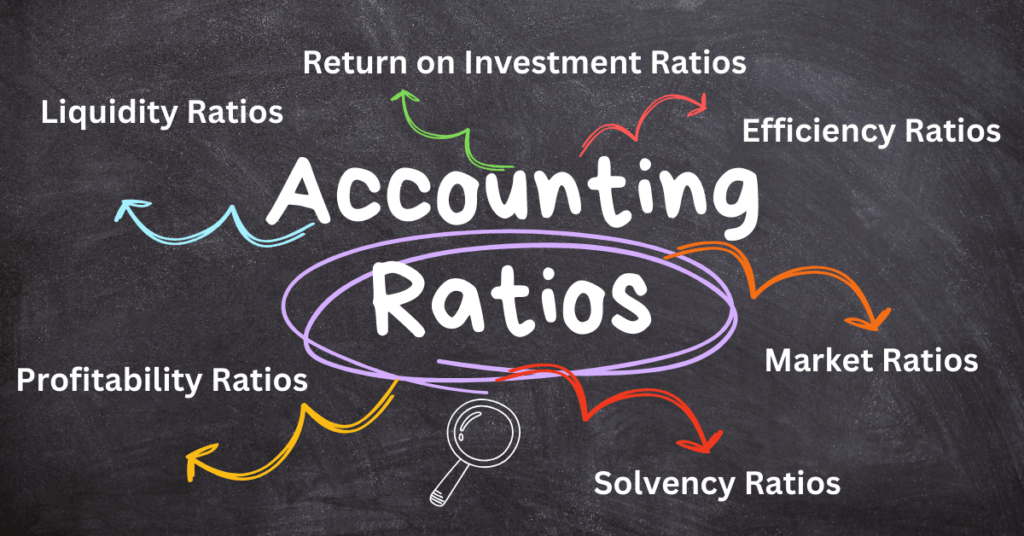

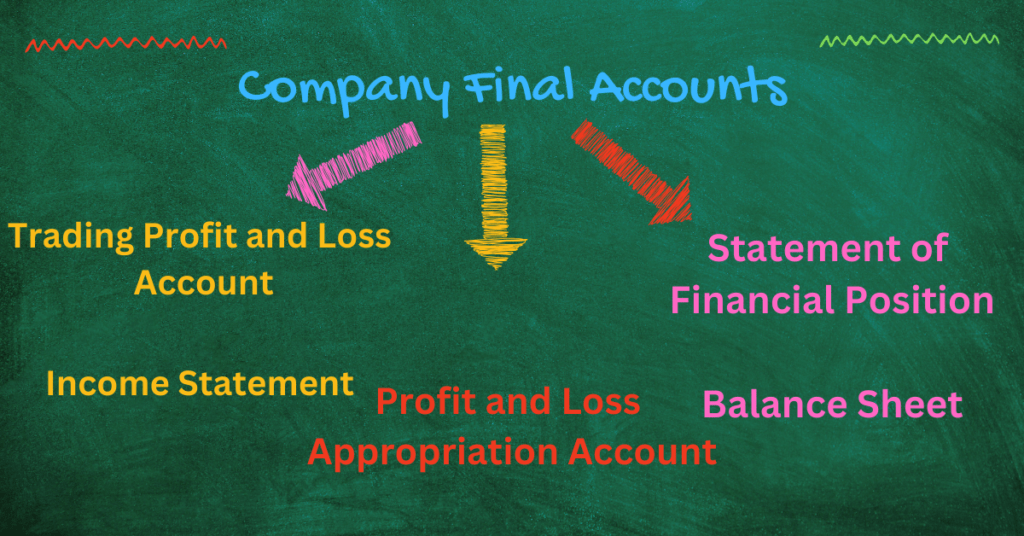

In this article, we are going to discuss 9. Contract Account, Features of Contract Account, Cost-Plus Contract, Advantages, Disadvantages, Example Problems. Contract Account is a topic of Advanced Financial Accounting. It is an important topic included in final exam papers of all leading universities such as Punjab University, University of Sargodha, along with all major Indian Universities. Lectures with problem questions of the Company Final Account, Accounting Ratios, and, Consignment Accounts are already published on the site.

Table of Contents

Written by Iftikhar Ali Lecturer Statistics, Accounting and Finance

Contract Account

Contract is an agreement between two parties, one is called the contractor who executes or performs the job, and the other one is called the contractee for whom the job is done by the contractor. As a reward, the contractor receives the input cost of the project including his monetary benefit. In larger projects, the project is segmented into stages, and on each stage completion, the cost will be paid by the contractee after work certification. Contract Account is the account to record the contract activity.

Features of Contract Account

- In larger time frame-oriented projects, the project is segmented into smaller sub-projects.

- Work must be executed on the work site to perform the project

- A separate account must be maintained for billing and to track the work done.

- Direct costs such as material, labor, and overhead costs incurred in the project.

- The certificate of work done or work certified is used for billing.

- Retention money is given to the contractor after examining the quality of the work done on the project.

- In some cases, penalties are also imposed on the contractor if terms are decided prior the execution of the project.

- Risk factor is also involved in the contract.

Work in Progress

Work in progress is an important part of the contract account. It consists of two components, work certified and work uncertified. These both are placed on the credit side of the contract account and the Asset side of the balance sheet. Work certified is the certification of the work done according to standards.

Profit & Loss

In the case of profit, it is placed on the debit side of the contract account and further segmented into two parts, one is called profit, and the other part of profit is transferred to account reserve. The part of net profit is placed on the liability side of the Balance Sheet, whereas the Account reserve for contingencies part of the profit is subtracted from the Work certified and uncertified from the Asset side of the Balance Sheet. It is also placed on the debit side of the contract account along with profit.

How to calculate profit?

If the amount received from the contractee is not given, the total profit is multiplied by 2/3, and the work-certified percentage

If the amount received from the contractee is given, the total profit is multiplied by 2/3 and further multiplied by the quotient of the amount received by the contractee and the amount of work certified.

Cost-Plus Contract

A Cost-Plus Contract refers to a contract in which the amount paid is more than the cost incurred in the contract. In Cost-Plus, ‘cost” comprises all the direct, indirect, or overhead costs to the contract whereas “plus” means any extra amount over than cost that simply means profit. In simple words, Cost-Plus means the predetermined amount agreed upon between parties more than the incurred cost of the contract.

Components of a Cost-Plus Contract

There are three major components of a Cost-plus contract:

1. Direct Cost: Direct costs refers to all direct costs of material, labor, and other direct costs incurred in the project.

2. Overhead Cost: Overhead costs refer to all allocated costs that cannot be ascertained or identified with activity level such as rent of building, depreciation, utility expenses, etc.

3. Profit: refers to the percentage that is predetermined between parties and it is above than incurred cost of the contract.

Types of Cost-Plus Contracts

Only the contractor’s profit or fee component may be paid differently under the terms of the contract.

1. Price + Fixed Percentage: The contractor gets a percentage on the cost of the project.

2. Cost + Fixed Fee Contract: The contractor gets fixed fee that is independent to the cost of the project.

3. Cost + Fixed Percentage / Fee and Incentive: Under this condition, contractor not only fixed percentage but receive incentive in case of early completion of the project.

Factors of Success of Cost-Plus Contract

It depends on the system or frame work that is adopted prior to the execution of the project.

1. For verification of costs, efficient system should be adopted.

2. Proper communication between contractor and contractee about the project completion status must be present.

3. All terms and conditions about the project must be decided prior to the execution of the project to stay away from disputes.

4. The contractor must has sufficient money to complete the project.

5. To ensure the proper use of accounting, audit, and proper record maintenance, a team should be present to monitor the process.

Advantages

Benefits of cost-plus contracts include:

- The Contractee is liable for the cost overrun and the contractor receives his agreed fee.

- The quality of the project is not compromised but improves because the budget constraint is not the problem of the contractor.

- The Contractor shall be fully aware of the costs incurred under the Project as he shall provide details of all costs when recovering costs from the Contractor.

- The final cost of the project may be lower than the estimated cost, which benefits the contractor.

- If material and labor costs are reduced, services are transferred to the contractor at the contractor’s cost.

Disadvantages

The disadvantages of cost-plus contracts are:

- If a contract or project is not completed within the period, the contractor may not get the funding of the contract.

- In case of non-completion of the contract within the time agreed between the parties, the contractor may get penalties.

- In the case of cost overruns, the contractor must provide a lot of additional evidence to justify the increase in project costs.

- Disputes regarding reimbursement of costs may arise between the contractor and the client.

- High costs are incurred in accounting, preparation of monthly reports, etc., to timely update about the contract progress and costs incurred on the contract.

- Sometimes, projects take more time than expected time to complete the project.

- There is uncertainty for the contractor because it is difficult to ascertain the final costs of the project.

Conclusion

Cost-plus contracts are most common in the construction industry, where the contractor is reimbursed as a contract profit for the number of expenses incurred on the contract and a percentage of the contract costs.

Example Problems for Understanding

Problem No 1:

The following were the expenditures on a contract for Rs. 600,000 commenced on 1-1-2010:

Material Rs. 120,000

Wages Rs. 164,400

Plant Rs. 20,000

Business Charges Rs. 8600

Cash received on account to 31st December amounted to Rs. 240,000 being 80% of work certified; the value of materials on hand at 31st December was Rs. 10,000. Prepare an account showing the position at the end of the year and the proportion of the profit which might reasonably be taken to profit and loss account after 10% depreciation on plant.

Solution:

Contract Account

| Particulars | Rs. | Particulars | Rs. |

| Material | 120,000 | Work in Progress A/C | |

| Wages | 164,400 | Work Certified: | |

| Plant | 20,000 | (240,000/80)100 | 300,000 |

| Business Charges | 8600 | Closing Stock | 10,000 |

| Plant: | |||

| 20,000×0.10=2000 | |||

| 20,000 – 2000=18,000 | 18,000 | ||

| Profit c/d | 15,000 | ||

| 328,000 | 328,000 | ||

| Profit & Loss A/c | Profit b/d | 15,000 | |

| (15,000 x 2/3)0.80 | 8000 | ||

| Work in Progress A/c | |||

| (Reserve for Contingencies) | 7000 | ||

| 15,000 | 15,000 |

Problem No 2:

Arslan Construction Company Ltd. Have undertaken the construction of a building for Rs. 3,12,500, subject to a retention money of 20% which will be paid after six months of completion of contract. Following details are shown from the books of Arslan Company Ltd. On 31st December 2010.

Materials issued from store Rs. 20300

Material Purchased Rs. 105000

Labor on site Rs. 101250

Depreciation on Plant Used during the year Rs. 3025

Overheads charged to the contract Rs. 9275

Direct Expenses Rs. 5750

Amount of work certified Rs. 275,000

Cash received from contractee Rs. 220,000

Cost of work uncertified Rs. 4125

Material on site on 31-12-2010 Rs. 1575

Accrued wages on 31-12-2010 Rs. 1950

Direct Expenses accrued on 31-12-2010 Rs. 400

From the above figures prepare:

- Contract Account

- Contractee Account

- Show the relevant items as would appear in the Balance Sheet as on 31-12-2010.

Solution:

Contract Account

| Particulars | Rs. | Particulars | Rs. |

| Materials issued from store | 20300 | Work in Progress | |

| Materials Purchased | 105000 | Work Certified 275000 | |

| Labor on site | 101250 | Add work uncertified 4125 | 279125 |

| Depreciation on Plant | 3025 | Materials at site Closing | 1575 |

| Overhead Charges | 9275 | ||

| Direct Expenses | 5750 | ||

| Accrued wages | 1950 | ||

| Direct Expenses Accrued | 400 | ||

| Profit c/d | 33,750 | ||

| 280,700 | 280,700 | ||

| Profit & Loss A/C: | Profit b/d | 33,750 | |

| (33750 x 2/3)220,000/275,000 or 80% | 18,000 | ||

| Balance c/d (Contingencies) | 15750 | ||

| 33,750 | 33,750 |

Contractee Account

| Particulars | Rs. | Particulars | Rs. |

| Balance c/d | 220,000 | Cash A/c | 220,000 |

| 220,000 | 220,000 |

Balance Sheet

As on December 31st 2010

| Liabilities | Rs. | Assets | Rs. |

| Profit & Loss A/c | 18000 | Work in Progress: | |

| Outstanding Direct Expenses | 400 | Work Certified 275000 | |

| Outstanding Wages | 1950 | Add work uncertified 4125 | |

| Less Profit c/f (15750) | |||

| Less Cash Received from Contractee (220,000) | 43375 | ||

| Materials on hand | 1575 |

Problem No 3:

A firm of builders, carrying out large contracts, kept in a contract ledger, separate accounts for each contract. On 30th June, 2010 the following was shown as being the expenditure in connection with Contract No. 555.

Material Purchased Rs. 58063

Material from stores Rs. 9785

Plant which had been use on other contracts Rs. 12523

Additional plant purchased Rs. 3610

Wages Rs. 73634

Direct Expenses Rs. 2026

Proportion of establishment charge Rs. 8720

The contract, which was commenced on 1st Feb, 2010, was for Rs. 300,000 and the amount certified by the Architect, after deduction of 20 percent retention money was Rs. 120,800, the work being certified to the 30th June, 2010. The materials on the site at that date were valued at Rs. 9858.

A contract plant Ledger was also kept, in which depreciation was dealt with monthly; the amount debited in respect on plant on Contract No 555 to 30th June, 2010 was Rs. 1130.

You are required to prepare an account showing the profit on contract to 30th June 2010.

Solution:

Contract Account

| Particulars | Rs. | Particulars | Rs. |

| Materials issued from store | 9785 | Work in Progress | |

| Materials Purchased | 58063 | Work Certified | 151000 |

| Wages | 73634 | Materials at site Closing | 9858 |

| Depreciation on Plant | 1130 | ||

| Establishment Charges | 8720 | ||

| Direct Expenses | 2026 | ||

| Profit c/d | 7500 | ||

| 160858 | 160858 | ||

| Profit & Loss A/C: | Profit b/d | 7500 | |

| (7500 x 2/3)0.80 | 4000 | ||

| Balance c/d (Contingencies) | 3500 | ||

| 7500 | 7500 |

Problem No 4:

A building contractor, having undertaken construction work at a contract price of Rs. 750,000 began the execution of work on 1st Jan, 2010. The following are the particulars of contract up to 31st Dec. 2010:

Machinery installed at site Rs. 45,000

Materials Sent to site Rs. 256047

Labor at site Rs. 223125

Direct Expenses Rs. 9501

Overhead charges allocated Rs. 12378

Materials returned from site Rs. 1647

Work certified by architect Rs. 585,000

Cash Received Rs. 540,000

Cost of work not certified yet Rs. 13,500

Materials on hand on 31-12-2010 Rs. 5649

Wages accrued on 31-12-2010 Rs. 8070

Value of machinery on 31-12-2010 Rs. 33,000

It was decided that the profit made on the contract in the year should be arrived at by deduction the cost of work certified from the total value of the architect’s certificates, that 1/3 of the profit so arrived at should be regarded as a provision against contingencies, and that such provision should be increased by taking to the credit of the Profit and Loss Account only such portion of the 2/3 profit as the cash received bore to the work certified.

Solution:

Contract Account

| Particulars | Rs. | Particulars | Rs. |

| Machinery Installed | 45000 | Work in Progress | |

| Materials | 256047 | Work Certified | |

| Labour | 223125 | Add Uncertified 13500 | 598500 |

| Direct Expenses | 9501 | Materials at site Closing | 5649 |

| Overhead Charges | 12378 | Machinery Closing | 33000 |

| Wages Accrued | 8070 | Materials Returned | 1647 |

| Profit c/d | 84675 | ||

| 638796 | 638796 | ||

| Profit & Loss A/C: | Profit b/d | 84675 | |

| 52108 | |||

| Balance c/d (Contingencies) | 32567 | ||

| 84675 | 84675 |

Problem No 5:

S & S Ltd are contractors for the construction of a pier for the Seaform Development Company. The value of the contract is Rs. 300,000 and payment is by engineer’s certificate subject to retention of 10% of the amount certified; this is to be held by the Seafront Development Company for six months after the completion of the contract.

The following information is extracted from the records of S and S Ltd.

Wages on site Rs. 41260

Materials delivered to site by supplier Rs. 58966

Materials delivered to the site from store Rs. 10180

Hire of plant Rs. 21030

Expenses charged to contract Rs. 3065

Overhead charged to contract Rs. 8330

Materials on site on 30th September 2010 Rs. 11660

Work certified Rs. 150,000

Payment received Rs. 135,000

Work in progress (not the subject of a certificate to date) Rs. 12613

Wages accrued on 30th September 2010 Rs. 2826

Materials costing Rs. 3384 was damaged and had to be disposed off for Rs. 884

Required: Prepare Contract Account and Work in Progress Account in the books of contractor, also shows the relevant items as would appear in the Balance Sheet.

Contract Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Materials delivered to site by supplier | 58966 | Material Closing | 11660 |

| Materials delivered to the site from store | 10180 | Work in Process: | |

| Hire of plant | 21030 | Work Certified 150,000 | |

| Wages on site 41260 | Work Uncertified 12613 | 162613 | |

| Add Outstanding 2826 | 44086 | Loss of Material | 3384 |

| Expenses charged to contract | 3065 | ||

| Overhead charged to contract | 8330 | ||

| Profit c/d | 32,000 | ||

| 177657 | 177657 | ||

| Profit & Loss | Profit b/d | 32,000 | |

| (32,000 x 2/3)0.90 | 19200 | ||

| Work in Progress (Reserve) | 12800 | ||

| 32,000 | 32,000 |

Work in Progress Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Contract Account: | Contract Account: | ||

| Work Certified 150,000 | Reserve for contingencies | 12800 | |

| Work Uncertified 12613 | 162613 | Balance c/d | 149813 |

| 162613 | 162613 |

Balance Sheet

As on 31st December 2010

| Liabilities | Rs. | Assets | Rs. |

| Wages Accrued | 2826 | Material on site closing | 11660 |

| Profit & Loss A/C 19200 | Work in Progress: | ||

| Less Loss of Material (2500) | 16700 | Work Certified 150,000 | |

| Add Work Uncertified 12613 | |||

| Less Cash received (135,000) | |||

| Less Reserve (12800) | 14813 | ||

| Cash | 884 |

Problem No 6:

X Ltd. Was awarded a contract to build an office block in Lahore and work commenced at the site on 1st March 2010.

During the period to 31st December 2010, the expenditures on the contract were as follows:

Materials issued from stores Rs. 94110

Material Purchased Rs. 280,700

Direct Expenses Rs. 61490

Wages Rs. 184,930

Charges made by the company for administration expenses Rs. 21460 plant and machinery purchased on 1st March, for use at site Rs. 121800

On 31st December 2010, the stock of material at site amounted to Rs. 21640 and there were amount outstanding for wages Rs. 3660 and direct expenses Rs. 490

X Ltd. Has received on account the sum of Rs. 641700 which represents the amount of Certificate No 1 issued by the architects in respect of work completed to 31st December 2010, after deducting 10% retention money.

The following relevant information is also available:

- The plant & machinery has an effective life of five years, with no residual value and;

- The company only takes credit for two-third of the profit on work certified.

Required: Prepare a contract account, work in progress account, and show the items appeared in Balance Sheet of X Ltd. on 31st December, 2010.

Solution:

Contract Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Materials from store | 94110 | Material Closing | 21640 |

| Materials purchased | 280700 | Work in Process: | |

| Direct Expenses 61490 | Work Certified & Uncertified | ||

| Add Outstanding 490 | 61980 | 713000 | |

| Wages 184930 | |||

| Add Outstanding 3660 | 188590 | ||

| Depreciation on Plant & Machinery | |||

| 20300 | |||

| Administrative Expenses | 21460 | ||

| Profit c/d | 67500 | ||

| 734640 | 734640 | ||

| Profit & Loss | Profit b/d | 67500 | |

| (67500 x 2/3)0.90 | 40500 | ||

| Work in Progress (Reserve) | 27000 | ||

| 67500 | 67500 |

Work in Progress Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Contract Account: | Contract Account: | ||

| Work Certified & Uncertified | 713,000 | Reserve for contingencies | 27000 |

| Balance c/d | 686000 | ||

| 713000 | 713000 |

Balance Sheet

As on 31st December 2010

| Liabilities | Rs. | Assets | Rs. |

| Outstanding Wages | 3660 | Material on site closing | 21640 |

| Outstanding Direct Expenses | 490 | Work in Progress: | |

| Profit & Loss A/C | 40500 | Work Certified & uncertified 713000 | |

| Less Profit c/f (27,000) | |||

| Less Cash received (641700) | 44300 | ||

| Machinery 121800 | |||

| Less Depreciation (20300) | 101500 |

You may also interested in the following:

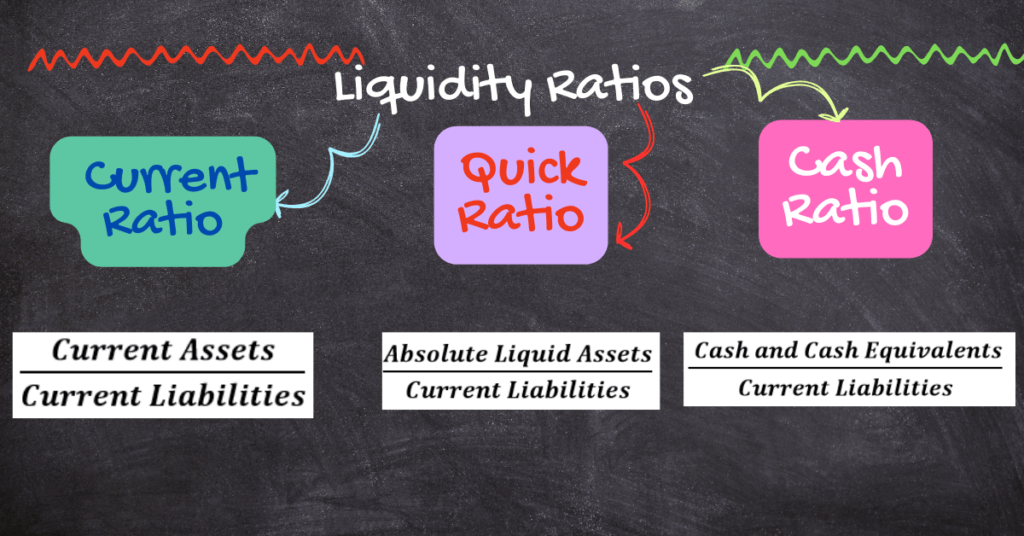

Analysis of Accounting Ratios, Exercise Problem Questions & their solutions

4.1: Company Final Account, Exercise Problems and their solutions

- Material Costing, Specific Identification Method, Weighted Average Cost Method, First In, First Out Method(FIFO), Last In, Fist Out Method(LIFO)

- Material Costing, Economic Order Quantity EOQ, Reorder Point/Ordering Point, Lead Time, Maximum Level of Inventory, Minimum Level of Inventory, Average Stock Level, Safety Stock, Danger Level, Optimum number of Orders, Order Frequency