In this post, we are going to discuss Cambridge IGCSE/O Level Accounting: Topic 1: Fundamentals of Accounting & The Accounting Equation. We are going to discover the topics of General Journal, Subsidiary Journals, Ledgers, Trial Balance, Income Statement, Difference between Book-keeping & Accounting, Objectives of Accounting, Users of Accounting and Accounting Equation.

Cambridge IGCSE/O Level Accounting: Topic 1: Fundamentals of Accounting & The Accounting Equation

Written by Iftikhar Ali M.Com/M.Sc Economics

Learning Objective: 1.1 The purpose of accounting

• understand and explain the difference between book-keeping and accounting

• state the purposes of measuring business profit and loss

• explain the role of accounting in providing information for monitoring progress and decision-making.

Table of Contents

Introduction

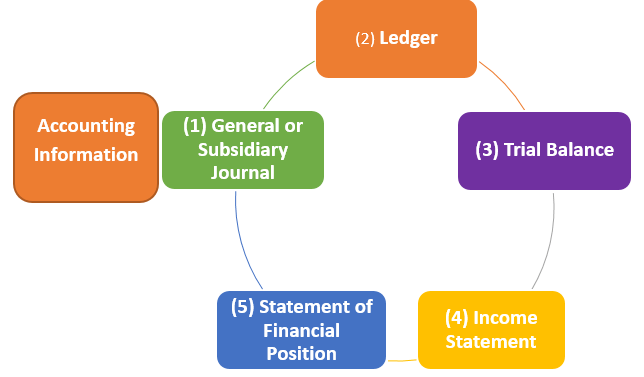

Accounting is the language of business. Business is a profit motive activity which must be expressed in monetary terms. These monetary dealings must be recorded in the form of business transactions. Business monetary information must go through the five steps:

- General Journal, Subsidiary Journals such as purchase, purchases return, sales, sales return journals, Cash Book

- Ledger

- Trial Balance

- Income Statement

- Statement of Financial Position or Balance Sheet

Above given five steps are called Accounting Cycle.

1st three are the part of Book-keeping and last two are the part of Accounting.

General Journal

General Journal is a day book in which day by day business transactions are recorded such as opening entries, assets acquisitions etc. other than subsidiary Journal transactions.

Subsidiary Journals

Subsidiary Journals are Journals in which we record credit purchases, credit purchases return, credit sales and credit sales return through invoices whereas in cash book, all cash receipts and cash disbursements are recorded. General Journal and subsidiary Journals are called books of first entry.

Ledger

Ledger is a collections of accounts. All the transaction recorded in journal transfer or posted in the Ledger in which individual accounts are prepared for further transfer in trial balance. It contains classified records of all transactions. Its balances are key to prepare trial balances and all financial statements.

Trial balance

Trial balance is a part of book-keeping which is prepared after making Journal and Ledger. All the balances those are taken from ledger accounts are placed in Debit and Credit side according to their favorable balances. In trial balance both sides must be equal. It has two types, one is called unadjusted trial balance and other one is called adjusted trial balance. Trial balance is important to make financial statements. Ledger and Trial balance are called books of final entry.

Income Statement

Income Statement is a financial statement which is prepared after equal intervals to know the profit or loss of the business entity. In case of profit, profit is distributed among stake holders and some part is saved as a reserve.

Statement of Financial Position is also a financial statement shows, what business owns is called Assets and what business owes is called liability.

Difference between Book-Keeping & Accounting

Difference between Book-Keeping & Accounting

Book-keeping

So we can say that book-keeping is the process of identifying and recording business transactions in such a way that can be useful for making financial statements such as income statement & statement of financial position. There are two methods to record transactions:

- Double Entry Book-Keeping

It is an Accounting method of recording transactions in which at-least two accounts are used in Debit and Credit aspects. In double entry book-keeping, debit side must be equals to credit side.

- Single Entry Book-Keeping

Under single entry Book-keeping only one cash account is considered. More simply, we can say cash income is added and expense is subtracted from the balance. It is less popular and less useful way to record business transactions.

Today, double entry book-keeping is considered worthy to record transactions.

Accounting

In Accounting, we make financial statements while using information gathered and recorded through book-keeping. Accounting identifies, measures and communicate economic information.

Reasons or objectives of Accounting

Stakeholders, General Public, Investors are interested to know:

- if they are making a profit or a loss;

- either business has worth or not;

- what a transaction was worth to them;

- how much cash and other liquid assets they have;

- how wealthy they are;

- how much they are owed;

- how much they owe to someone else;

- Enough information so that they can keep a financial check on the things they do.

Users of accounting information

Possible users of accounting information include:

Managers: They use accounting information to make day to day business decision making process.

Owner or stake holders of the business: They have keen interest to know either business is profitable and making progress or not.

A prospective buyer: When buyer wants to buy the business, must see the financial statements because he/she must know the assets, liabilities, equity, liquid assets, cash flows, financial obligations etc.

The bank: In case of borrowing by the business, bank must check its worth to repay loans.

Tax inspectors: They need financial statements to calculate the tax.

A prospective partner: If the owner wants to share ownership with someone else, then the partner will want such information.

Investors: either existing ones or potential ones. They want to know to make the decision for investment

Auditors: They also need financial statements to check and compare the results and position.

Learning Objective: 1.2 The accounting equation

• explain the meaning of assets, liabilities and owner’s equity

• explain and apply the accounting equation.

Business is a separate legal entity which means that all business records are recorded and maintained separately and business owner or owners are treated separately.

Capital or Owner’s Equity:

When a person or group of persons, promoters of business want to establish a business they need to invest physical and financial assets to the business as capital. Physical assets such as building, machinery, equipment, furniture etc. and financial assets such as bonds, cash, stocks etc. so any resource provided by owner to run the business is called capital or owner’s equity.

Assets

Resources that have economic value and owned by an individual, organization or entity. Assets are integrated into business for future value. Assets have various types such as:

- Intangible: Non-physical such as intellectual property, copyright, Trademarks, Goodwill etc.

- Tangible: Physical such as building, car, furniture, machinery, equipment etc.

- Financial: such as bonds, stocks, cash etc.

- Investments: resources invested while expecting future profitability.

- Current: short term cashable within one year.

- Long Term: long term liquidity more than one year.

- Natural resource: come from earth such as oil, minerals, coal, timber etc.

- Derivatives: Financial contracts such as options and future trading etc.

Liabilities

Liabilities are obligations or debts that a business organization or individual owes to external parties. Liabilities always arise due to past transactions and it is a future sacrifice of financial resource. There are two main types of liabilities:

Current liabilities

- Current liabilities: obligations those are expected to be settled within one year such as:

Account payable: money owed to vendors for credit purchases.

Short term loans: payable within one year.

Accrued liabilities: Expenses incurred but not yet paid.

Unearned Revenues: advance amount receives for goods or services.

Fraction of long term debt: fraction of long term debt payable within year

Long Term Liabilities

- Long Term Liabilities: Obligation payable after one year such as:

Long term loans: Loans payable after one year.

Bonds Payable: Debt securities issued to generate or raise capital.

Deferred Tax: Tax payable in next year.

Pension obligations: Pensions payable to the retired workers.

Lease payments: Payments obligated for the asset acquired on lease.

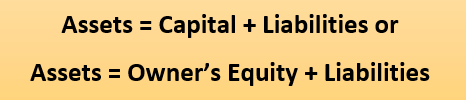

Accounting Equation

According to the accounting rules, assets are always equals to:

There are three components of accounting equation, on the basis of simple mathematics, if you know two elements of equation, you can calculate third one.

Example

Example

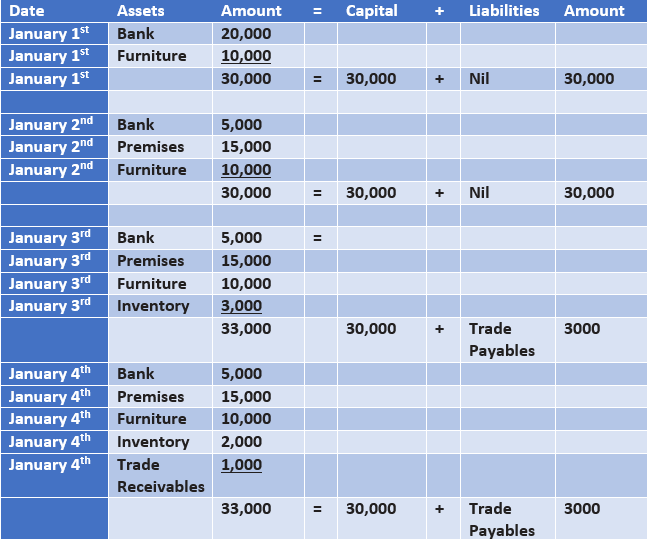

January 1 Darwesh set up a business to trade under the name of The Dress Shop. He opened a business bank account and paid in $20 000, and bring furniture amounted to $ 10 000 as capital.

2 The business purchased premises, $15 000, and paid by cheque.

3 The business purchased goods, $3 000, on credit.

4 The business sold goods, at the cost price of $1 000, on credit.

Show the accounting equation after each of the above transactions.

Solution:

You may also interested in the following links:

Cambridge IGCSE/O LEVEL Topic: 2 Sources and recording of data, Double Entry Book-keeping

1.1 Principles of Accounting, Journal, Ledger, Trial Balance

Analysis of Accounting Ratios, Exercise Problem Questions & their solutions

Sir, Very helpful 🙏 much gratitude! Please more helpful articles for O-Levels Accounting.

Thank You very much.