In this article, we are going to discuss 9. Contract Account, Practical Problems and Solutions. In previous post we have discussed already about Contract Account, Features of Contract Account, Cost-Plus Contract, Advantages, Disadvantages, Example Problems. Contract Account is a topic of Advanced Financial Accounting. It is an important topic included in final exam papers of all leading universities such as Punjab University, University of Sargodha, along with all major Indian Universities. Lectures with problem questions of the Company Final Account, Accounting Ratios, and, Consignment Accounts are already published on the site.

Written by Iftikhar Ali M.Sc Economics, M.Com (Finance) Lecturer Statistics, Accounting and Finance

Contract Account, Practical Problems and Solutions

Problem No 7:

The following particulars relate to a contract undertaken by Ali Developers Engineers:

- Material sent to site Rs. 85349

- Labour engaged on site Rs. 74375

- Plant installed at cost Rs. 15,000

- Direct Expenditure Rs. 3167

- Establishment Charges Rs. 4126

- Material returned to stores Rs. 549

- Work certified Rs. 195,000

- Cost of work not certified Rs. 4500

- Material in hand at the end of the year Rs. 1883

- Wages accrued at the end of the year Rs. 2400

- Direct expenses accrued at the end of the year Rs. 240

- Value of plant at the end of year Rs. 11,000

- The contract price has been agreed at Rs. 250,000

- Cash received from contractee was Rs. 180,000

You are required to prepare Contract Account showing profit, Contractees’s Account and to show suitable entries in the Balance sheet of contractor.

Solution:

Contract Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Materials Sent on site | 85349 | Material Closing | 1883 |

| Labor engaged on site 74375 | Work in Process: | ||

| Add Outstanding 2400 | 76775 | Work Certified 195,000 | |

| Plant installed at cost | 15000 | Add Work Uncertified 4500 | 199500 |

| Direct Expenses 3167 | Material returned to store | 549 | |

| Add Outstanding 240 | 3407 | Ending Value of Plant | 11000 |

| Establishment Charges | 4126 | ||

| Profit c/d | 28275 | ||

| 212932 | 212932 | ||

| Profit & Loss | Profit b/d | 28275 | |

| (28275\ \left( \frac{2}{3} \right)\left( \frac{180000}{195000} \right)\ | 17400 | ||

| Work in Progress (Reserve) | 10875 | ||

| 28275 | 28275 |

Contractee’s Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Balance c/d | 180,000 | Cash A/c | 180,000 |

| 180,000 | 180,000 |

Balance Sheet

As on 31st December 2010

| Liabilities | Rs. | Assets | Rs. |

| Outstanding Wages | 2400 | Material in hand | 1883 |

| Outstanding Direct Expenses | 240 | Work in Progress: | |

| Profit & Loss A/C | 17400 | Work Certified 195,000 | |

| Work Uncertified 4500 | |||

| Less Reserve for contingencies (10875) | |||

| Less Cash Received (180000) | 8625 | ||

| Material in store | 549 | ||

| Plant | 11000 |

Problem No 8:

An expenditure of Rs. 194,000 has been incurred on a contract to the 31st March, 2010. The value of work done and certified is Rs. 220,000. The cost of work done but not yet certified is Rs. 6,000. It is estimated that the contract will be completed by 30th June 2010 and an additional expenditure of rs. 40,000 will have to be incurred to complete the contract. The total estimated expenditure on the contract is to include a provision of for contingencies. The contract price is Rs. 280,000 and Rs. 200,000 has been realized in cash upto 31st March 2010. Calculate the proportion of profit to be taken to profit and loss account as on 31st March 2010.

Solution:

| Computation of Estimated Profit | |

| Total Expenditure upto 31st March 2010 | 194000 |

| Add Estimated Additional Expenditure | 40,000 |

| 234,000 | |

| Add Provision for contingencies | |

| \left( \frac{234,000}{97.5} \right)\ 2.5 | 6000 |

| Estimated Total Expenditures | 240,000 |

| Contract Price | 280,000 |

| Estimated Total Profit | 40,000 |

Computation of Profit & Loss on 31-03-2010

Estimated\ Total\ Profit\ \left( \frac{Work\ Certified}{Contract\ Price} \right)\left( \frac{Cash\ Received}{Work\ Certified} \right)\ 40000\ \left( \frac{220000}{280000} \right)\left( \frac{200000}{220000} \right) = 28571\Problem No 9:

A firm of building contractors began to trade on 1st April, 2009. The following was the expenditure on the contract for Rs. 300,000

Material issued to contract Rs. 51,000; Plant used for contract Rs. 15,000, Wages incurred Rs. 81,000; other expenses incurred Rs. 5,000

Cash received on account by 31st March, 2010 amounted to Rs. 128,000, being 80% of the work certified. Of the plant and materials charged to the contract, plant which cost Rs. 3000 and materials which cost Rs. 2500 were lost. On 31st March 2010 plant which cost Rs. 2000 was returned to stores, the cost of work done but uncertified was Rs. 1000 and material costing Rs. 2300 were in hand on site.

Charge 15% depreciation of plant and take to the profit and loss account 2/3 of the profit received. Prepare a Contract Account, Contractee’s Account and Balance sheet from the above particulars.

Solution:

Contract Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Materials issued | 51000 | Material Closing | 2300 |

| Plant Used | 15000 | Work in Process: | |

| Wages incurred | 81000 | Work Certified 160,000 | |

| Other expenses incurred | 5000 | Add Work Uncertified 1000 | 161,000 |

| Depreciation on Plant: | Plant returned to store | 2000 | |

| (15000 – 3000)0.15 | 1800 | Plant lost | 3000 |

| Material Lost | 2500 | ||

| Plant at site(15000 – 2000 – 3000) | 10000 | ||

| Profit c/d | 27000 | ||

| 180800 | 180800 | ||

| Profit & Loss | Profit b/d | 27000 | |

| (27000\ \left( \frac{2}{3} \right)(0.80)\ | 14400 | ||

| Work in Progress (Reserve) | 12600 | ||

| 27000 | 27000 |

Contractee’s Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Balance c/d | 128,000 | Cash A/c | 128,000 |

| 128,000 | 128,000 |

Balance Sheet

As on 31st December 2010

| Liabilities | Rs. | Assets | Rs. |

| Profit & Loss A/C 14400 | Material in hand | 2300 | |

| Less Loss of Plant (3000) | Work in Progress: | ||

| Less Loss of Material (2500) | 8900 | Work Certified 160,000 | |

| Work Uncertified 1000 | |||

| Less Reserve for contingencies (12600) | |||

| Less Cash Received (128000) | 20400 | ||

| Plant Less Depreciation | |||

| (15,000 – 3000) – 1800 | 10200 |

Problem No 10:

A contractor makes up his accounts to December, 31 in each year. Contract No. 534 commenced on April 1, 2010. The cost records yield the following information on December 31st 2010.

- Material charged out to site Rs. 2150

- Labour Rs. 5011

- Foreman Rs. 631

A machine costing Rs. 1500 has been on site for 73 days. Its working life is estimated at five years, its final scrap value of Rs. 100.

A supervisor, who is paid Rs. 1200 per annum, has spent approximately one half of his time on this contract.

All other expenses and administration expenses amounted to Rs. 1261. Materials in store at site at year end cost Rs. 248.

The contract price is Rs. 20,000. On 31st December, 2010 2/3 of the contract was completed. Architect’s certificate has been issued covering Rs. 10,000 and Rs. 8000 has so far been paid on account.

Prepare a contract account and state how much profit or loss should be included in respect of Contract No. 534 in the financial accounts to 31st December, 2010.

Hint: Cost of work uncertified Rs. 2328

Solution:

Contract Account

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

| Materials charge | 2150 | Material Closing | 248 |

| Labour | 5011 | Work in Process: | |

| Foreman | 631 | Work Certified 10,000 | |

| Depreciation on Machine | Add Work Uncertified 2328 | 12328 | |

| \frac{1500 – 100}{5} = 280,\ \left( \frac{280}{365} \right)73\ | 56 | ||

| Supervision Expenses: | |||

| \frac{1200}{2} = 600,\left( \frac{600}{12} \right)9\ | 450 | ||

| Other Expenses | 1261 | ||

| Profit c/d | 3017 | ||

| 12576 | 12576 | ||

| Profit & Loss | Profit b/d | 3017 | |

| 3017\ \left( \frac{2}{3} \right)\left( \frac{8000}{10000} \right)\ | 1609 | ||

| Work in Progress (Reserve) | 1408 | ||

| 3017 | 3017 |

| Working 1 Work Certified | |

| Materials charge | 2150 |

| Labour | 5011 |

| Foreman | 631 |

| Depreciation on Machine | 56 |

| Supervision Expenses | 450 |

| Other Expenses | 1261 |

| 9559 | |

| Less Material at site | (248) |

| Cost of 2/3 of contract | 9311 |

| Cost of Full Contract: | |

| \left( \frac{9311}{2} \right)3 | 13966.5 |

| Cost of Work Certified: | |

| \left( \frac{10000}{20000} \right)13966.5\ | 6983.25 |

| Cost of 2/3 of contract | 9311 |

| Less Cost of work certified | (6983.25) |

| Work uncertified | 2327.75 |

Problem No 11:

The following particulars relate to two houses which a firm of builders had in course of construction under contract:

| House A | House B | |

| Work-in-progress on 1st Jan, 2010 excluding Rs. 800 estimated profit which was taken to profit & loss account in 2009. | 14,000 | |

| Material Purchased | 23,000 | 16,600 |

| Wages | 20,000 | 14,000 |

| Electric Services and fittings | 1400 | 300 |

| Road making charges | 8000 | |

| Contract Price (including road making) | 60,000 | 40,000 |

| Cash Received upto 31st December, 2010 | 60,000 | 24,000 |

| Percentage of Cash received to work certified | 100% | 66\frac{2}{3}\%\ |

| Value of materials in hand on 31st Dec, 2010 | 400 | 540 |

| Completed work not certified | 2500 | |

| Value of plant used on site | 12,000 | 6000 |

| Period of plant remained on sites during the year | 10 months | 8 months |

The total establishment expenses incurred during the year 2010 amounted to Rs. 12240. These are to be charged to the two contracts in proportion to wages. Depreciation of plant is to be taken into account at the rate of 10% per annum.

Prepare the two contract accounts (in columnar form) showing the profit or loss on each house for the year 2010 and the sums which you consider appropriately transferable to the profit and loss account.

Solution:

Contract Account

| Particulars | (A) Dr. | (B)Cr. | Particulars | (A)Dr. | (B)Cr. |

| Work in Progress Opening Including estimated Profit | 14800 | Value of materials in hand on 31st Dec, 2010 | 400 | 540 | |

| Material Purchased | 23,000 | 16,600 | Plant returned to store less depreciation: | ||

| Wages | 20,000 | 14,000 | A: (12000 x 0.10)10/12 = 1000 | ||

| Electric Services and fittings | 1400 | 300 | (12,000 – 1000) | 11,000 | |

| Road making charges | 8000 | B: (6000 x 0.10)8/12 = 1000 | |||

| Establishment charges | (6,000 – 400) | 5600 | |||

| \left( \frac{12240}{34000} \right)20000,\left( \frac{12240}{34000} \right)14000\ | 7200 | 5040 | Work in Progress: | ||

| Value of plant used on site | 12,000 | 6000 | Work Certified for A | 60,000 | |

| Work Uncertified for A | 0 | ||||

| Work Certified for B: | |||||

| Profit c/d | 2700 | \left( \frac{24000}{66.67} \right)100\ | 36000 | ||

| Work Uncertified for B | 2500 | ||||

| Profit & Loss A/c | 15000 | ||||

| 86400 | 44640 | 86400 | 44640 | ||

| Profit & Loss Account: | Profit b/d | 2700 | |||

| 2700(2/3)(24000/36000) | 1200 | ||||

| Work in Progress (Reserve) | 1500 | ||||

| 2700 | 2700 |

Problem No 12:

The following information relates to a contract for Rs. 75,00,000 (the contractee paying 90% of the value of work done as certified by the architect)

| 2008 | 2009 | 2010 | |

| Material | 900000 | 1100000 | 630000 |

| Wages | 950000 | 1150000 | 850000 |

| Direct Expenses | 35000 | 125000 | 45000 |

| Indirect Expenses | 15000 | 20000 | |

| Work Certified | 1750000 | 5650000 | 7500000 |

| Work in Progress uncertified | 100000 | ||

| Plant issued | 100000 |

The value of plant at the end of 2008, 2009 and 2010 was, respectively Rs. 80,000; Rs.50,000 and Rs. 20,000. Prepare the Contract Accounts for the year 2008, 2009 & 2010.

Solution:

Contract Account

| Date | Particulars | Amount | Date | Particulars | Amount |

| 2008 | Material | 900000 | 2008 | Work in Progress: | |

| Wages | 950000 | Work Certified | 1750000 | ||

| Direct Expenses | 35000 | Plant Value at the end | 80000 | ||

| Indirect Expenses | 15000 | Profit & Loss A/C(Loss) | 170000 | ||

| Plant Issued | 100000 | ||||

| 2000000 | 2000000 | ||||

| 2009 | Work Certified | 1750000 | 2009 | Work in Progress: | |

| Plant Value at the end | 80000 | Work Certified | 5650000 | ||

| Material | 1100000 | Work in Progress uncertified | 100000 | ||

| Wages | 1150000 | Plant Value at the end | 50000 | ||

| Direct Expenses | 125000 | ||||

| Indirect Expenses | 20000 | ||||

| Profit & Loss: | |||||

| (1575000 x 2/3)0.90 | 945000 | ||||

| WIP (Reserve) | 630000 | ||||

| 5800000 | 5800000 | ||||

| 2010 | Work in Progress: | 2010 | WIP (Reserve) b/d | 630000 | |

| Work Certified | 5650000 | Contractee’s A/c | 7500000 | ||

| Work in Progress uncertified | 100000 | Plant Value at the end | 20000 | ||

| Plant Value at the end | 50000 | ||||

| Material | 630000 | ||||

| Wages | 850000 | ||||

| Direct Expenses | 45000 | ||||

| Profit & Loss A/C | 825000 | ||||

| 8150000 | 8150000 |

You may also interested in the following topics:

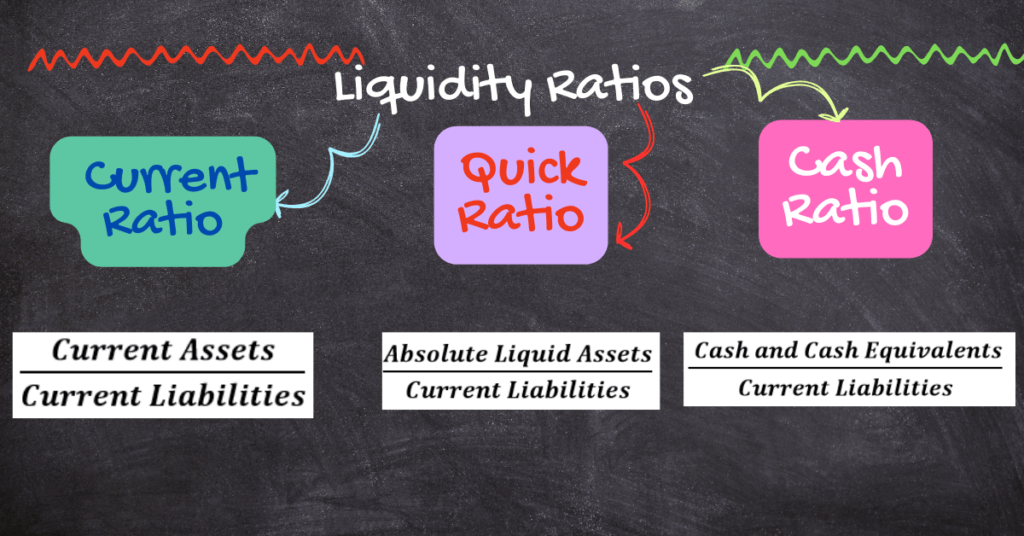

Analysis of Accounting Ratios, Exercise Problem Questions & their solutions

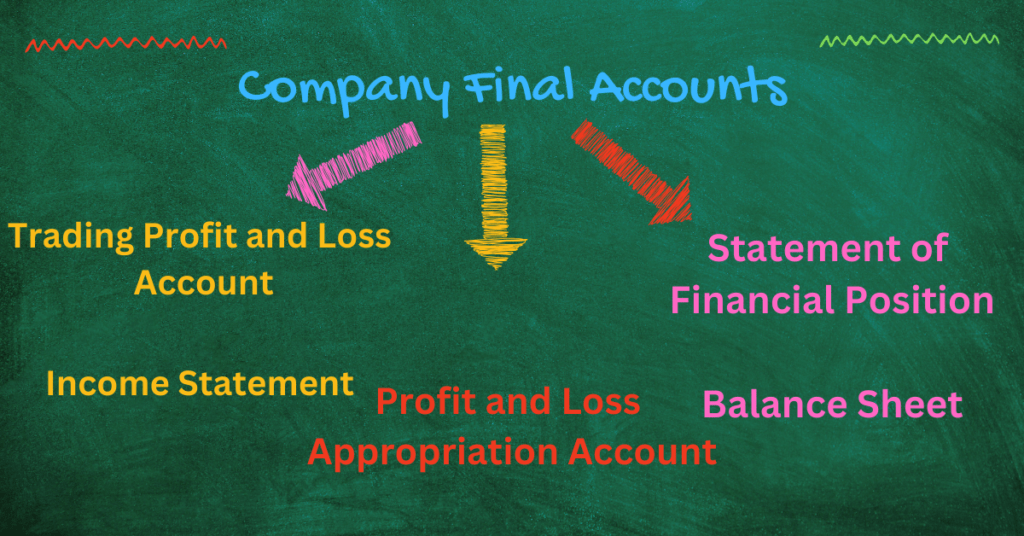

4.1: Company Final Account, Exercise Problems and their solutions

- Material Costing, Specific Identification Method, Weighted Average Cost Method, First In, First Out Method(FIFO), Last In, Fist Out Method(LIFO)

- Material Costing, Economic Order Quantity EOQ, Reorder Point/Ordering Point, Lead Time, Maximum Level of Inventory, Minimum Level of Inventory, Average Stock Level, Safety Stock, Danger Level, Optimum number of Orders, Order Frequency