In this post, I am going to discuss Depreciation, Methods of Depreciation, Straight Line/ Original Cost/Fixed Instalment Method, Diminishing/Declining/Reducing Balance Method, Reasons of depreciation, Important Journal entries, theoretical aspects & Example short and extensive questions for understanding with Important MCQ’s of Depreciation

Table of Contents

Depreciation

Depreciation is the wear and tear value of physical or tangible fixed assets such as machinery, plant, vehicle, etc.; due to deterioration over the period of time. There are different depreciation methods such as original cost or declining balance method etc.

Reasons of Depreciation

- Wear & Tear: Assets deteriorate due to continuous usage.

- Time Laps: Some types of assets become useless after some time.

- Obsolescence: Due to new technology, old technology is discarded.

Methods of Depreciation

Straight Line/ Original Cost/Fixed Instalment Method

In Fixed installment method of depreciation, depreciation is calculated each time on the original cost of the asset.

Diminishing/Declining/Reducing Balance Method

Under the reducing, declining, or diminishing method, depreciation is charged each time on the balance or book value of the asset.

Characteristics of Depreciation

- Only Charged on Non-Current Assets

- Depreciation should not exceed than cost of the asset

- It must be calculated on the cost of the asset

Internal & External Causes of Depreciation

Internal causes of depreciation

- Wear & Tear

- Exhaustion

- Depletion

- Deterioration

External causes of depreciation

- Time

- Obsolescence

- Weather & natural Calamities

- Fall in the market Value

Scrap/Residual Value

Scrap Value, Residual Value, Salvage Value, or Break-up Value is the estimated selling price value of the scrap asset after charging full depreciation.

Difference between Tangible and intangible Asset

Tangible Assets

Tangible assets are assets that are physical and can be touched such as buildings, machinery, furniture, etc.

Intangible Assets

Intangible assets are assets that are non-physical such as Goodwill, Patents, trademarks, Software, etc.

Amortization

Amortization is the cost of intangible assets over a period of time besides this it is used to repayment of loan over a period of time.

Difference among Depletion, Depreciation, and Obsolescence

Depletion

Depletion is just like the depreciation of natural resources such as timber, mining and petroleum industries, etc.

Depreciation

Depreciation is the wear and tear value of physical or tangible fixed assets due to deterioration over a period of time. There are various depreciation methods such as original cost or declining balance method etc.

Obsolescence

When an asset becomes obsolete or outdated and useless, this state is called obsolescence.

Wear and tear in depreciation

Physical deterioration of physical assets due to usage over a period of time is called wear and tear.

Accumulated Depreciation

Accumulated depreciation is the total amount of depreciation that has been charged against an asset since the asset was first acquired.

Obsolescence

When an asset becomes obsolete or outdated and useless, this state is called obsolescence.

Fluctuation

The increase or decrease in the market value of an asset due to market forces is called fluctuation.

Wasting asset

A wasting asset is an asset that has a limited life and its value declines as time passes such as depreciation in machinery, motor car, etc.

Difference between Deprecation and Fluctuation in market price

Depreciation is the wear and tear value of physical or tangible assets due to deterioration over a period of time. There are various depreciation methods such as original cost or declining balance method etc.

The rise and fall in the value of fixed assets due to market reasons is called fluctuation in market price.

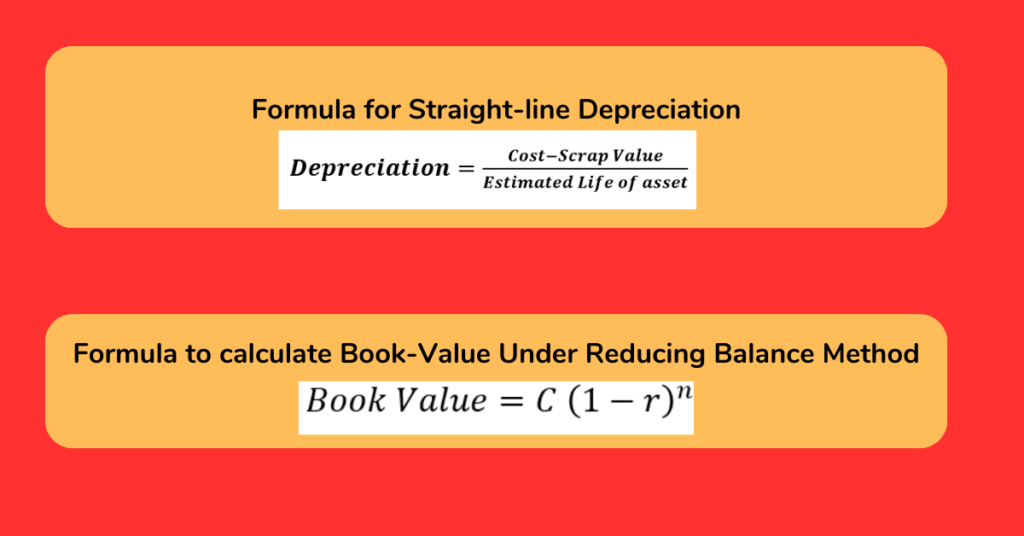

Formula for Straight-line Depreciation

![]()

Important Journal Entries for Depreciation

- When asset is acquired

| Date | Detail | Dr. | Cr. |

| XXXX | Asset Dr. | XXX | XXX |

| Cash/Bank Cr. |

- Cost of installing asset if any.

| Date | Detail | Dr. | Cr. |

| XXXX | Asset Dr. | XXX | XXX |

| Cash/Bank Cr. |

- Depreciation Entry

| Date | Detail | Dr. | Cr. |

| XXXX | Depreciation Dr. | XXX | XXX |

| Asset Cr. |

- Selling Asset

| Date | Detail | Dr. | Cr. |

| XXXX | Cash/Bank Dr. | XXX | XXX |

| Asset Cr. |

- Journal Entry for Profit

| Date | Detail | Dr. | Cr. |

| XXXX | Asset Dr. | XXX | XXX |

| Profit & Loss Cr. |

- Journal Entry for Loss

| Date | Detail | Dr. | Cr. |

| XXXX | Profit & Loss Dr. | XXX | XXX |

| Asset Cr. |

Short Numerical Questions

Example Short Question 1 for Understanding

Under the “straight line method”, what is the annual rate of depreciation if, the cost price of an asset is Rs.2500, scrap value Rs.500 and life is 5 years.

Answer:

Data: Cost = 2500, Scrap Value = 500, Estimated Life = 5 Years

![]()

![]()

![]()

Example Short Question 2 for Understanding

On 1st January 2010, a firm purchased machinery worth Rs. 20,000 and spent Rs. 2,000 on its installation, the rate of depreciation is 10% p.a. then what will be the book value of asset under the written down value method after three years?

Solution:

Cost (C) = 22,000, Depreciation Rate (r) = 10%, Time Period (n) = 3 Years

Method = Written Down Value Method

Formula

![]()

![]()

![]()

Extensive Numerical Questions

Extensive Question 1 for Understanding

On 1st July 2002, Ali purchased a second hand machine for Rs. 18000 and spent Rs.2000 on its repair and installation. On 30th June 2005 the machinery was disposed of for a sum of Rs. 13,600. Assuming the books are closed on 31st December each year and taking the rate of depreciation at 10% p.a. on diminishing balance.

Required: Show the machinery account of all years.

Solution:

Machine Account

| Date | Detail | Rs. | Date | Detail | Rs. |

| 1st Jul, 2002 | Cash A/C | 18,000 | 31st Dec, 2002 | Depreciation A/C | 1,000 |

| 1st Jul, 2002 | Cash A/C | 2,000 | |||

| 31st Dec, 2002 | Balance c/d | 19,000 | |||

| 20,000 | 20,000 | ||||

| 1st Jan 2003 | Balance b/d | 19,000 | 31st Dec, 2003 | Depreciation A/C | 1,900 |

| 31st Dec, 2003 | Balance c/d | 17,100 | |||

| 19,000 | 19,000 | ||||

| 1st Jan 2004 | Balance b/d | 17,100 | 31st Dec, 2004 | Depreciation A/C | 1,710 |

| 31st Dec, 2004 | Balance c/d | 1,5390 | |||

| 17,100 | 17,100 | ||||

| 1st Jan 2005 | Balance b/d | 1,5390 | 30th Jun, 2005 | Depreciation A/C | 769.5 |

| 30th Jun, 2005 | Cash A/C | 13,600 | |||

| 30th Jun, 2005 | P&L A/C (Loss) W:1 | 1020.5 | |||

| 1,5390 | 1,5390 |

W:1 Calculation of Profit or Loss

| Cost | 20,000 |

| Less Depreciation for 2002 | (1,000) |

| Less Depreciation for 2003 | (1900) |

| Less Depreciation for 2004 | (1710) |

| Less Depreciation for 2005 | (769.5) |

| Book Value at the time of Sale | 14620.5 |

| Selling Price Realized | (13,600) |

| Loss | 1020.5 |

Extensive Question 2 for Understanding

A manufacturing firm purchased on 1st of January, 2001 certain Machinery for Rs. 100,000 and spent Rs.2,000 on its erection. On 1st of July in the same year additional machinery costing Rs.50,000 was acquired. On 1st of January, 2003 the machinery purchased on 1st of January, 2001 having become obsolete was auctioned for Rs.40,000 and on the same date fresh machinery was purchased at a cost of Rs.25,000. Depreciation was provided annually on 31st December at the rate of 10% p.a. on the original cost of the asset. In 2003 however, this method was changed and that of writing off 15% on the written down value was adopted. Required: Give Machinery Account from 2001 to 2005.

Solution:

Machinery Account

| Date | Detail | Rs. | Date | Detail | Rs. |

| 1st Jan, 2001 | Cash A/C | 100,000 | 31st Dec, 2001 | Depreciation A/C 1st Mach. | 10,200 |

| 1st Jan, 2001 | Cash A/C | 2,000 | |||

| 1st Jan, 2001 | Cash A/C | 50,000 | 31st Dec, 2001 | Depreciation A/C 2nd Mach. | 2,500 |

| 31st Dec, 2001 | Balance c/d | 139,300 | |||

| 152,000 | 152,000 | ||||

| 1st Jan 2002 | Balance b/d | 139,300 | 31st Dec, 2002 | Depreciation A/C 1st Mach. | 10,200 |

| Depreciation A/C 2nd Mach. | 5,000 | ||||

| 31st Dec, 2002 | Balance c/d | 124,100 | |||

| 139,300 | 139,300 | ||||

| 1st Jan 2003 | Balance b/d | 124,100 | 1st Jan 2003 | Cash A/C | 40,000 |

| 1st Jan 2003 | Cash A/C | 25,000 | (Note: No Dep. for 1st Mach.) | ||

| 1st Jan 2003 | P&L A/C (Loss 1st Mach.) W:1 | 41,600 | |||

| 31st Dec, 2003 | Depreciation A/C 2nd Mach. | 6375 | |||

| 31st Dec, 2003 | Depreciation A/C 3rd Mach. | 3750 | |||

| 31st Dec, 2003 | Balance c/d | 57,375 | |||

| 149,100 | 149,100 | ||||

| 1st Jan 2004 | Balance b/d | 57,375 | 31st Dec, 2004 | Depreciation A/C 2nd & 3rd Mach. | 8606.25 |

| 31st Dec, 2004 | Balance c/d | 48768.75 | |||

| 57,375 | 57,375 | ||||

| 1st Jan 2005 | Balance b/d | 48768.75 | 31st Dec, 2005 | Depreciation A/C 2nd & 3rd Mach. | 7315.3125 |

| 31st Dec, 2005 | Balance c/d | 41453.4375 | |||

| 48768.75 | 48768.75 |

W:1 Calculation of Profit or Loss for 1st Machinery

| Cost | 102,000 |

| Less Depreciation for 2001 | (10200) |

| Less Depreciation for 2002 | (10200) |

| Less Depreciation for 2003 | (0) |

| Book Value at the time of Sale | 81,600 |

| Selling Price Realized | (40,000) |

| Loss | 41,600 |

Extensive Question 3 for Understanding

On 1st January 2002 a firm purchased a truck for Rs. 15000. Deprecation is charged @ 20% p.a. on the written down value method. On 31st December 2005 it was arranged to replace the old Truck with a new one cost Rs. 18000 and an allowance of Rs. 4500 being made from the purchase price of new one.

Required

Show the truck Account for four years.

Solution:

Truck Account

| Date | Particulars | Rs. | Date | Particulars | Rs. |

| 2002 | 2002 | ||||

| 1st Jan | Cash A/C | 15,000 | 31st Dec | Depreciation A/C | 3,000 |

| 31st Dec | Balance c/d | 12,000 | |||

| 15,000 | 15,000 | ||||

| 2003 | 2003 | ||||

| 1st Jan | Balance b/d | 12,000 | 31st Dec | Depreciation A/C | 2400 |

| 31st Dec | Balance c/d | 9600 | |||

| 12,000 | 12,000 | ||||

| 2004 | 2004 | ||||

| 1st Jan | Balance b/d | 9600 | 31st Dec | Depreciation A/C | 1920 |

| 31st Dec | Balance c/d | 7680 | |||

| 9600 | 9600 | ||||

| 2005 | 2005 | ||||

| 1st Jan | Balance b/d | 7680 | 31st Dec | Depreciation A/C | 1536 |

| 31st Dec | Cash A/C | 13,500 | |||

| (18000 – 4500) | 31st Dec | Profit & Loss A/C (Loss) W:1 | 1644 | ||

| 31st Dec | Balance c/d | 18,000 | |||

| 21180 | 21180 |

| W:1 Calculation of Profit or Loss for replacing old truck | |

| Cost | 15,000 |

| Less Depreciation for 2002 | (3,000) |

| Less Depreciation for 2003 | (2400) |

| Less Depreciation for 2004 | (1920) |

| Less Depreciation for 2005 | (1536) |

| Book Value | 6144 |

| Less Allowance | (4500) |

| Loss on Replacing Old Truck | 1644 |

Extensive Question 4 for Understanding

Reproduce and complete the following table on your answer book

| Cost (Rs.) | Scrap Value (Rs.) | Annual Depreciation under fixed Installment Method Rs. | Life (Years | |

| I | 8000 | 200 | ? | 10 |

| II | ? | 500 | 800 | 12 |

| III | 5300 | ? | 1000 | 5 |

| IV | 6000 | 400 | 700 | ? |

| V | 3000 | Nil | ? | 15 |

Solution:

Working 1

![]()

Working 2

![]()

![]()

800 x 12 = Cost – 500

9600 = Cost – 500

Cost = 9600 + 500 = 10100

Working 3

![]()

![]()

![]()

![]()

![]()

Working 4

![]()

![]()

![]()

![]()

Working 5

![]()

Reproduction of Table

| Cost (Rs.) | Scrap Value (Rs.) | Annual Depreciation under fixed Installment Method Rs. | Life (Years | |

| I | 8000 | 200 | 780 W.1 | 10 |

| II | 10100 W.2 | 500 | 800 | 12 |

| III | 5300 | 300 W.3 | 1000 | 5 |

| IV | 6000 | 400 | 700 | 8 W.4 |

| V | 3000 | Nil | 200 W.5 | 15 |

Extensive Question 5 for Understanding

ABC Company purchased machinery for Rs. 70,000, on 1st July, 2002. They spent Rs. 8,000 on its installation. Prepare the machinery account for the first four years under straight line method of depreciation. Depreciation is written off @ 10% per annum. Assume the Accounts are closed every year on 31st December.

Solution:

Machinery Account

| Date | Detail | Rs. | Date | Detail | Rs. |

| 1st Jul, 2002 | Cash A/C | 70,000 | 31st Dec, 2002 | Depreciation A/C | 3900 |

| 1st Jul, 2002 | Cash A/C | 8,000 | |||

| 31st Dec, 2002 | Balance c/d | 74,100 | |||

| 78,000 | 78,000 | ||||

| 1st Jan, 2003 | Balance b/d | 74,100 | 31st Dec, 2003 | Depreciation A/C | 7800 |

| 31st Dec, 2003 | Balance c/d | 66,300 | |||

| 74,100 | 74,100 | ||||

| 1st Jan, 2004 | Balance b/d | 66,300 | 31st Dec, 2004 | Depreciation A/C | 7800 |

| 31st Dec, 2004 | Balance c/d | 58,500 | |||

| 66,300 | 66,300 | ||||

| 1st Jan, 2005 | Balance b/d | 58,500 | 31st Dec, 2005 | Depreciation A/C | 7800 |

| 31st Dec, 2005 | Balance c/d | 50,700 | |||

| 58,500 | 58,500 |

Extensive Question 6 for Understanding

On 1st January 2001 a firm purchased machinery worth of Rs. 50,000/-. On 1st July 2003 it buys additional machinery worth Rs. 10,000/- and spends Rs. 1,000/- on its erection. The accounts are closed each year on 31st Dec. Assuming the normal depreciation to be 10% per annum, show the machinery account for four years under fixed installment method.

Solution:

Machinery Account

| Date | Detail | Rs. | Date | Detail | Rs. |

| 1st Jan, 2001 | Cash A/C | 50,000 | 31st Dec, 2001 | Depreciation A/C | 5000 |

| 31st Dec, 2001 | Balance c/d | 45,000 | |||

| 50,000 | 50,000 | ||||

| 1st Jan, 2002 | Balance b/d | 45,000 | 31st Dec, 2002 | Depreciation A/C | 5000 |

| 31st Dec, 2002 | Balance c/d | 40,000 | |||

| 45,000 | 45,000 | ||||

| 1st Jan, 2003 | Balance b/d | 40,000 | 31st Dec, 2003 | Depreciation A/C | 5000 |

| 1st Jul, 2003 | Cash A/C | 10,000 | |||

| 1st Jul, 2003 | Cash A/C | 1000 | 31st Dec, 2003 | Depreciation A/C | 550 |

| 31st Dec, 2003 | Balance c/d | 45,450 | |||

| 51,000 | 51,000 | ||||

| 1st Jan, 2004 | Balance b/d | 45,450 | 31st Dec, 2004 | Depreciation A/C | 5000 |

| 31st Dec, 2004 | Depreciation A/C | 11,00 | |||

| 31st Dec, 2004 | Balance c/d | 39,350 | |||

| 45,450 | 45,450 |

Extensive Question 7 for Understanding

A transport company purchased 10 motor trucks at Rs. 90,000 each, on 1st April 2002. On 1st October 2004 one of the truck got an accident and was completely destroyed. Rs. 54000 are received from the insurer in full settlement. On the same day another truck was purchased for the sum of Rs. 100,000. The company wrote off depreciation @ 20% on the original cost per annum and observed the calendar year as its financial year. Give the motor truck account from 2002 to 2004.

Solution:

Trucks Account

| Date | Detail | Rs. | Date | Detail | Rs. |

| 1st Apr, 2002 | Cash A/C | 900,000 | 31st Dec, 2001 | Depreciation A/C | 135,000 |

| 31st Dec, 2001 | Balance c/d | 765,000 | |||

| 900,000 | 900,000 | ||||

| 1st Jan, 2003 | Balance b/d | 765,000 | 31st Dec, 2003 | Depreciation A/C | 180,000 |

| 31st Dec, 2003 | Balance c/d | 585,000 | |||

| 765,000 | 765,000 | ||||

| 1st Jan, 2004 | Balance b/d | 585,000 | 1st Oct, 2004 | Depreciation A/C (destroyed truck) | 13,500 |

| 1st Oct, 2004 | Cash A/C | 100,000 | |||

| 1st Oct, 2004 | Profit & Loss (Profit) A/C W:1 | 9000 | 31st Dec, 2004 | Depreciation A/C | 162,000 |

| 31st Dec, 2004 | Depreciation A/C | 5000 | |||

| 31st Dec, 2004 | Balance c/d | 513500 | |||

| 694,000 | 694,000 |

W:1 Calculation of Profit or Loss for Destroyed Truck

| Cost of Truck | 90,000 |

| Less Depreciation for 2002 | (13,500) |

| Less Depreciation for 2003 | (18,000) |

| Less Depreciation for 2002 | (13,500) |

| Book Value | 45,000 |

| Insurance Claim | (54,000) |

| Profit | 9,000 |

Important MCQ’s of Depreciation

| 1 | What is depreciation? | |

| A. An expense | B. A liability | |

| C. A revenue | D. A profit | |

| 2 | What is the decline in the value of an asset proportionate to the quantum of its production e.g. mine, quarry etc. called? | |

| A. Amortization | B. Depletion | |

| C. Depreciation | D. Wear and tear | |

| 3 | Depreciation is recorded On the: | |

| A. Debit side of Trading Account | B. Credit side of Trading Account | |

| C. Debit side of profit and loss Account | D. Credit side of profit and loss Account | |

| 4 | In fixed installment method, depreciation is calculated on: | |

| A. Book value | B. Market price | |

| C. Scrap value | D. Original cost | |

| 5 | If original cost of asset is 45,000, Scrap value is Rs. 3000, estimated life is 7 years then the annual value of depreciation will be. | |

| A. Rs. 6000 | B. Rs. 7000 | |

| C. Rs. 6500 | D. Rs. 8000 | |

| 6 | The value of an asset at the end of working life is called_____. | |

| A. Original cost | B. Book value | |

| C. Scrap value | D. Market value | |

| 7 | The term depreciation is used with reference to_____. | |

| A. Tangible assets | B. Intangible assets | |

| C. Current assets | D.Fixed assets | |

| 8 | Depreciation arises because of______. | |

| A. Fall in the market value of an asset | B. Physical wear and tear | |

| C. Fall 1n the value of money | D. Increase in the value of money | |

| 9 | Under straight line method, the amount of depreciation is _______. | |

| A. Decreases every year | B. Increases every year | |

| C. Both A and B | D. Constant every year | |

| 10 | Reducing Balance method is also known as _____. | |

| A. Diminishing Balance Method | B. Written down value Method | |

| C. Book value Method | D. All of these | |

| 11 | If original cost of the asset is Rs. 10,000/- rate of depreciation is 10%, then value of depreciation under diminishing balance method after 3rd year will be _____. | |

| A. Rs. 1000/- | B. Rs. 900/- | |

| C. Rs. 700/- | D. Rs 810/- | |

| 12 | Loss on the sale of machinery should be written off against____________. | |

| A. Share premium Account | B. Sales Account | |

| C. Depreciation Fund Account | D. Scrap Account | |

| 13 | Depreciation arises because of: | |

| A. Fall 1n the market value of an asset | B. Damage during work | |

| C. Physical wear and tear | D. Fall in the market value of money | |

| 14 | The value of asset after its useful life is called: | |

| A.Replacement value | B. Resale value | |

| C. Residual value | D. Market value | |

| 15 | Depreciation is charged against _____. | |

| A. Expense | B. Revenue | |

| C. Liability | D. Capital | |

| 16 | Depreciation occurs ______. | |

| A. Up to one year | B. Up to two years | |

| C. Till the last day of the estimated life of asset | D. Up to the replacement of old asset | |

| 17 | Depreciation | |

| A. Reduces productive activity | B. Reduces value of asset gradually | |

| C. Is a regular loss | D. All of these | |

| 18 | Suppose cost of asset is Rs. 1,000/- and rate of depreciation 10% p.a. The book value of asset after two years will be ______ | |

| A. Rs.1000 | B. Rs. 810 | |

| C. Rs.900 | D. Rs. 729 | |

| 19 | Depreciation on the diminishing balance method of Rs. 2000 at the rate of 10% p.a after three years will be: | |

| A. Rs. 1400 | B. Rs. 1458 | |

| C. Rs. 542 | D. None of these | |

| 20 | Depreciation of an asset should not exceed the: | |

| A. Original cost | B. Depreciable value | |

| C. Market price | D. Scrap value | |

| 21 | The period during which the asset will help in earning income of business is known as: | |

| A. Consumed life | B. Expired life | |

| C. Exhausted life | D. Working life | |

| 22 | A firm bought a machine for Rs. 16000. It is expected to be used for five years then sold for Rs. 1000. What will be the annual amount of depreciation under straight line method? | |

| A. Rs. 3200 | B. Rs. 3100 | |

| C. Rs. 3750 | D. Rs. 3000 | |

| 23 | Decline in the value proportionate to the quantum of production, e.g. mine, quarry, etc. is called: | |

| A. Amortization | B. Depletion | |

| C. Depreciation | D. Wear and tear | |

| 24 | The physical deterioration in assets due to use in business is called: | |

| A. Depletion | B. Obsolescence | |

| C. Wear and tear | D. Accident | |

| 25 | Which one of the following is a tangible asset? | |

| A. Goodwill | B. Trademark | |

| C. Copyright | D. Machinery | |

| 26 | The book value of machinery on January 01st 2003 is Rs.20,000/-. Two years later, the book value is Rs.10,000/-. The straight line depreciation rate of charge each year is: | |

| A. 7.5% | B. 17.5% | |

| C. 25% | D. 33.5% | |

| 27 | The value of Assets may rise or fall on account of: | |

| A. Depreciation | B. Depletion | |

| C. Fluctuation | D. Amortization | |

| 28 | In straight line method, depreciation is calculated on: | |

| A. Book value | B. Market value | |

| C. Scrap value | D. Original cost | |

| 29 | Original cost of machinery Rs. 5,500, scrap value Rs. 500, the useful life of machinery 10 years, then the annual value of deprecation will be: | |

| A. Rs. 500 | B. Rs. 550 | |

| C. Rs. 1000 | D. Rs. 1500 | |

| 30 | Amount which will be realized at the end of asset’s useful life, is called: | |

| A. Written down value | B. Market value | |

| C. Remaining value | D. Residual value | |

| 31 | The process of allocating the cost of an intangible asset over its useful life, is called: | |

| A. Depreciation | B. Amortization | |

| C. Obsolescence | D. Deterioration | |

| 32 | Book value of an asset is equal to: | |

| A. Cost – Depreciation | B. Cost – Salvage value | |

| C. Market value – Depreciation | D. Net realizable value – Depreciation | |

| 33 | Which of the following is not a depreciable asset? | |

| A. Equipment | B. Machinery | |

| C. Land | D. Motor car | |

| 34 | Depreciation arises because of: | |

| A. Fall in the market value of an asset. | B. Physical wear and tear | |

| C. Fall in the value of money | D. Increase in the value of money | |

| 35 | The decreases in the value of intangible asset is known as: | |

| A. Amortization | B. Depreciation | |

| C. Appreciation | D. Depletion | |

| 36 | The need for provision of depreciation is necessary to: | |

| A. Ascertainment of true profit or loss | B. Ascertainment of true cost of production | |

| C. Replacement of assets | D. All of these | |

| 37 | The need for provision of depreciation is necessary to: | |

| A. Ascertainment of true profit or loss | B. Ascertainment of true cost of production | |

| C. Replacement of assets | D. All of these | |

| 38 | Depreciation occurs: | |

| A. Up to one year | B. Up to two years | |

| C. Till the last day of the estimated working life of asset | D. Up to the replacement of old asset | |

| 39 | Original cost of asset is Rs. 45000, Scrap value is Rs. 3000, useful life of asset is 7 years, then the annual value of depreciation will be: | |

| A. Rs. 6000 | B. Rs. 7000 | |

| C. Rs. 6500 | D. Rs. 8000 | |

| 40 | The Amount of depreciation charged on machinery will be debited to: | |

| A. Machinery account | B. Cash account | |

| C. Depreciation Account | D. Trading Account | |

You may also interested in other resources. Follow below link:

If you are interested to learn consignment account, Just Click Me

If you are interested in Journal, Ledger & Trial Balance, Just Click Me

If you are interested in IGCSE/OLEVEL Accounting, Just Click Me

If you are interested in Cost Accounting, Just Click Me

For previous paper resources, Just Click here