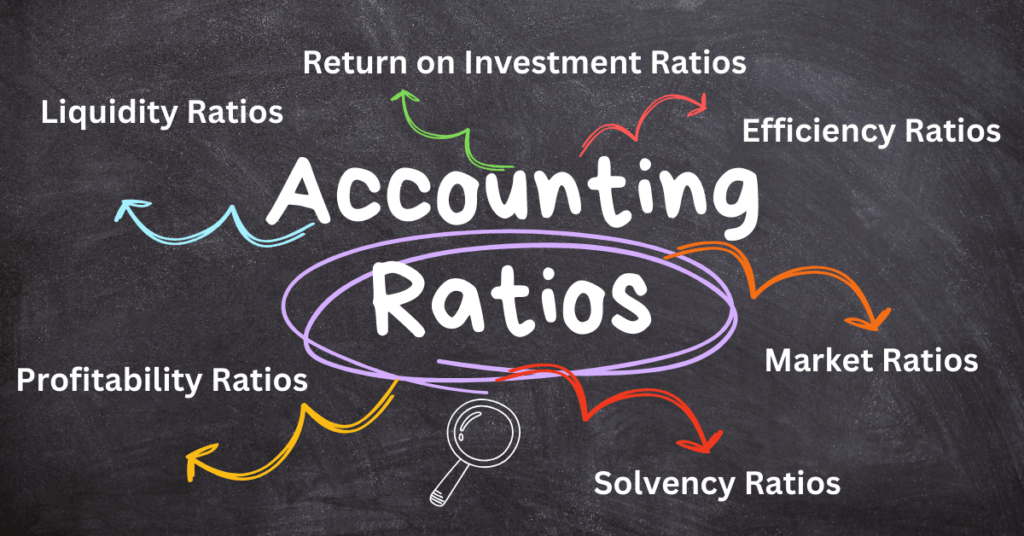

In this post, we are going to discuss Exercise Problem Questions & their solutions of the Topic Analysis of Accounting Ratios. If you want to learn more about Accounting Ratios, its type, formulas with more practical example questions, then click here.

Table of Contents

Analysis of Accounting Ratios, Exercise Problem Questions & their solutions

Problem Question 1

Following is the Balance sheet of XYZ Ltd. As on 31st December, 2005

| Liabilities | Rs. | Assets | Rs. |

| Equity Share Capital | Machinery | 400,000 | |

| 2400 shares of 100 each | 240,000 | Furniture | 50,000 |

| Profit & Loss Account | 60,000 | Stock | 120,000 |

| 10% Debentures | 150,000 | Sundry Debtors | 90,000 |

| Sundry Creditors | 150,000 | Cash at bank | 22,800 |

| Provision for Taxation | 10,000 | Prepaid Insurance | 7200 |

| Bank Overdraft | 80,000 | ||

| 690,000 | 690,000 |

- Sales Rs. 600,000

- Gross Profit 20% on Cost

Calculate following ratios:

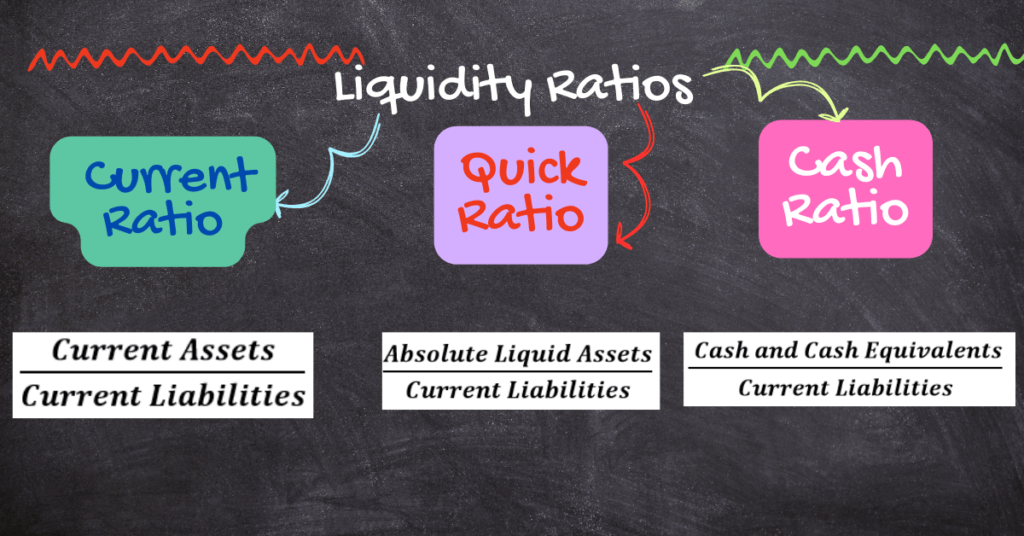

- Current Ratio

- Liquidity Ratio

- Stock Turnover Ratio

- Debtors Turnover Ratio

Solution:

![]()

![]()

![]()

![]()

| Working: 1Current Assets & Current Liabilities | |||

| Current Liabilities | Rs. | Current Assets | Rs. |

| Sundry Creditors | 150,000 | Stock | 120,000 |

| Provision for Taxation | 10,000 | Sundry Debtors | 90,000 |

| Bank Overdraft | 80,000 | Cash at bank | 22,800 |

| Prepaid Insurance | 7200 | ||

| 240,000 | 240,000 | ||

| Working 2: Liquid Assets | |

| Liquid Assets | Rs. |

| Current Assets | 240,000 |

| Less Stock | (120,000) |

| Less Prepaid Expenses | (7200) |

| Liquid Assets | 112,800 |

| Working 3: Cost of Goods Sold | |

| Assumed Cost | 100 |

| Add Gross Profit 20% of Cost | 20 |

| Sales | 120% |

Note: If Sales is Rs. 600,000 which is 120% then Cost will be:

![]()

Problem Question 2

Calculate the following ratios from the balance sheet given below:

- Current Ratio

- Quick Ratio

- Debt-Equity Ratio

- Proprietary Ratio

- Fixed Asset Ratio

| Liabilities | Rs. | Assets | Rs. |

| Equity Share Capital | 500,000 | Plant & Machinery | 800,000 |

| Reserves & Surplus | 100,000 | Furniture & Fixture | 200,000 |

| 12% Mortgage Loan | 440,000 | Stock | 220,000 |

| 10% Debentures | 160,000 | Debtors | 120,000 |

| Bank Overdraft | 100,000 | Prepaid Expenses | 8,000 |

| Creditors | 80,000 | Cash in Hand | 52,000 |

| Outstanding Expenses | 20,000 | ||

| 14,00,000 | 14,00,000 |

Solution:

![]()

![]()

![]()

![]()

![]()

| Working: 1Current Assets & Current Liabilities | |||

| Current Liabilities | Rs. | Current Assets | Rs. |

| Bank Overdraft | 100,000 | Stock | 220,000 |

| Creditors | 80,000 | Debtors | 120,000 |

| Outstanding Expenses | 20,000 | Prepaid Expenses | 8,000 |

| Cash in Hand | 52,000 | ||

| 200,000 | 400,000 | ||

| Working 2: Quick/Liquid Assets | |

| Quick/Liquid Assets | Rs. |

| Current Assets | 400,000 |

| Less Stock | (220,000) |

| Less Prepaid Expenses | (8000) |

| Quick/Liquid Assets | 172,000 |

| Working 3: Long Term Debt | |

| Long Term debt | Rs. |

| 12% Mortgage Loan | 440,000 |

| 10% Debentures | 160,000 |

| Long Term Debt | 600,000 |

| Working 4: Equity | |

| Rs. | |

| Equity Share Capital | 500,000 |

| Reserves & Surplus | 100,000 |

| Total Equity | 600,000 |

| Working 5: Net Fixed Assets | |

| Rs. | |

| Plant & Machinery | 800,000 |

| Furniture & Fixture | 200,000 |

| Net Fixed Assets | 10,00,000 |

| Working 6: Long Term Funds | |

| Rs. | |

| Equity Share Capital | 500,000 |

| Reserves & Surplus | 100,000 |

| 12% Mortgage Loan | 440,000 |

| 10% Debentures | 160,000 |

| Total Long Term Funds | 12,00,000 |

Problem Question 3

The following is the balance sheet of ABC enterprises Ltd. For the year ended on 31st December, 2005.

| Liabilities | Rs. | Assets | Rs. |

| Share Capital | 200000 | Goodwill | 120000 |

| Capital Reserve | 40000 | Fixed Assets | 280000 |

| 12% Debentures | 100000 | Stock | 60000 |

| Profit & Loss A/C | 60000 | Investment (Short term) | 20000 |

| Sundry Creditors | 80000 | Cash | 60000 |

| Provision for Taxation | 40000 | ||

| Bank Overdraft | 20000 | ||

| 540,000 | 540,000 |

Calculate the following ratios:

- Current Ratio

- Liquidity Ratio

- Proprietary Ratio

- Debt-Equity Ratio

- Return on Equity Ratio

Solution:

![]()

![]()

![]()

![]()

![]()

| Working: 1Current Assets & Current Liabilities | |||

| Current Liabilities | Rs. | Current Assets | Rs. |

| Sundry Creditors | 80000 | Stock | 60000 |

| Provision for Taxation | 40000 | Investment (Short term) | 20000 |

| Bank Overdraft | 20000 | Cash | 60000 |

| 140,000 | 140,000 | ||

| Working 2: Quick/Liquid Assets | |

| Quick/Liquid Assets | Rs. |

| Current Assets | 140,000 |

| Less Stock | (60,000) |

| Less Prepaid Expenses | (0) |

| Quick/Liquid Assets | 80,000 |

| Working 3: Share Holders Fund/Equity | Rs. |

| Share Capital | 200000 |

| Capital Reserve | 40000 |

| Profit & Loss A/C | 60000 |

| Total Share Holders Fund/Equity | 300,000 |

| Working 4: Long Term Debt | |

| 12% Debentures | 100000 |

| Long Term Debt | 600,000 |

Problem Question 4

Compute the debtors turnover ratio and debtors collection period from the following:

| 2004 | 2005 | |

| Gross Sales | 950000 | 800000 |

| Cash Sales | 100000 | 75000 |

| Sales Return | 50000 | 25000 |

| Debtors in the beginning of the year | 73000 | — |

| Bills Receivable in the beginning of the year | 10000 | — |

| Debtors at the end of the year | 102000 | 77000 |

| Bill Receivable at the end of the year | 15000 | 6000 |

Solution:

![]()

![]()

![]()

![]()

| Working 1: Net Credit Sales | ||

| 2004 | 2005 | |

| Gross Sales | 950000 | 800000 |

| Less Cash Sales | (100000) | (75000) |

| Less Sales Return | (50000) | (25000) |

| Net Credit Sales | 800,000 | 700,000 |

Working 2: Average Total Debtors

![]()

![]()

![]()

Problem Question 5

Chand & Co. purchases goods both for cash and credit. The following figures have been taken from their books:

| Total Purchases | 425000 |

| Cash Purchases | 113000 |

| Return Outwards | 12000 |

| Creditors at the end of year | 53200 |

| Bills Payable at the end of year | 6800 |

Taking a year of 365 days, calculate creditors turnover ratio and average payment period.

Solution:

![]()

![]()

| Working 1:Net Credit Purchases | |

| Total Purchases | 425000 |

| Cash Purchases | (113000) |

| Return Outwards | (12000) |

| Net Credit Purchases | 300,000 |

Working 2: Average Total Creditors

Note: Opening Bills Payable and Creditors are not given so only closing are treated.

![]()

Problem Question 6

From the summarized balance sheet given below of a company, calculate:

- Stock turnover ratio

- Debtors Turnover Ratio

- Working Capital Turnover Ratio

- Fixed Assets Turnover Ratio

| Liabilities | Rs | Assets | Rs |

| Equity | 124000 | Fixed Assets | 208000 |

| Long term Loans | 110000 | Stock | 46000 |

| Current Liabilities | 74000 | Debtors | 44000 |

| Cash | 10000 | ||

| 308000 | 308000 |

Sales Rs. 400,000; Gross Profit 20%

Solution

![]()

![]()

![]()

![]()

| Working 1: Cost of Sales | |

| Sales | 400,000 |

| Less Gross Profit 20% of 400,000 | (80,000) |

| Cost of Sales | 320,000 |

| Working 2: Current Assets | |

| Stock | 46000 |

| Debtors | 44000 |

| Cash | 10000 |

| Current Assets | 100,000 |

| Working 3: Net Wokring Capital | |

| Current Assets | 100,000 |

| Less Current Liabilities | (74,000) |

| Cost of Sales | 26,000 |

Problem Question 7

From the following Trading and Profit & Loss Account of Allied Chemical Ltd., compute:

- Gross Profit Ratio

- Operating Profit Ratio

- Operating Ratio

- Net Profit Ratio

- Stock Turnover Ratio

| Detail | Dr. Rs. | Detail | Cr. Rs. |

| Stock | 55000 | Sales | 843500 |

| Purchases | 465000 | Stock | 79500 |

| Factory Expenses | 143000 | ||

| Gross Profit c/d | 260000 | ||

| 923,000 | 923,000 | ||

| Office Expenses | 50,000 | Gross Profit b/d | 260,000 |

| Selling Expenses | 30,000 | Profit on Sale of car | 20,000 |

| Distribution Expenses | 20,000 | Interest on Investment | 40,000 |

| Provision for doubtful debts | 4000 | ||

| Depreciation | 16,000 | ||

| Interest on debentures | 14,000 | ||

| Loss of cash by theft | 6,000 | ||

| Net Profit | 180,000 | ||

| 320,000 | 320,000 |

Solution

![]()

![]()

![]()

![]()

![]()

![]()

| Working 1: Operating Profit | |

| Net Profit | 180,000 |

| Add Non Operating Expenses: | |

| Interest on debentures | 14,000 |

| Loss of cash by theft | 6,000 |

| Less Non Operating Income: | |

| Profit on Sale of car | (20,000) |

| Interest on Investment | (40,000) |

| Net Operating Profit | 140,000 |

| Working 2: Cost of Goods Sold | |

| Sales | 8,43,500 |

| Less Gross Profit | (260,000) |

| Cost of Goods Sold | 583500 |

| Working 3: Operating Expenses | |

| Office Expenses | 50,000 |

| Selling Expenses | 30,000 |

| Distribution Expenses | 20,000 |

| Provision for doubtful debts | 4000 |

| Depreciation | 16,000 |

| Operating Expenses | 120,000 |

Working 4 Average Stock

![]()

Problem Question 8

Following are the extracts taken from the financial statements of Paradise Paper Ltd. at the year end 31st December 2010.

| Particulars | Rs. | Particulars | Rs. |

| Gross Sales | 650,000 | Long term Liabilities | 80,000 |

| Sales Return | 10,000 | Cash | 21,000 |

| Net Profit before Tax | 50,000 | Marketable Securities | 17,000 |

| Interest Expenses | 12,000 | Accounts Receivable | 47,000 |

| Income Tax Rate | 40% | Inventory | 50,000 |

| Cost of Goods Sold | 452,000 | Net Fixed Assets | 200,000 |

| Operating Expenses | 126,000 | Paid up Capital @ Rs. 10 each | 100,000 |

| Total Current Liabilities | 75,000 | Profit & Loss A/C (Cr.) | 30,000 |

| General Reserve | 50,000 |

The company had issued 10,000 equity shares on 31-12-2010. Market value per share on 31-12-2010 was Rs. 25.

Calculate:

- Current Ratio

- Earnings Per Share

- Debt-Equity Ratio

- Interest Coverage Ratio

- Price/Earnings Ratio

Solution:

![]()

![]()

![]()

![]()

![]()

| Working 1: Current Assets & Current Liabilities | |||

| Current Assets | Rs. | Current Liabilities | Rs. |

| Cash | 21,000 | Total Current Liabilities | 75,000 |

| Marketable Securities | 17,000 | ||

| Accounts Receivable | 47,000 | ||

| Inventory | 50,000 | ||

| Total Current Assets | 135,000 | Total Current Liabilities | 75,000 |

| Working 2:Long Term Debt | Rs. |

| Long term Liabilities | 80,000 |

| Total Long Term Debt | 80,000 |

| Working 3: Long Term Fund | Rs. |

| Paid up Capital @ Rs. 10 each | 100,000 |

| Profit & Loss A/C (Cr.) | 30,000 |

| General Reserve | 50,000 |

| Long term Liabilities | 80,000 |

| Total Long Term Funds | 260,000 |

| Working 4:EBIT | Rs. |

| Net Profit Before Tax | 50,000 |

| Add Interest Charge | 12,000 |

| Earning Before Interest & Tax | 62,000 |

Problem Question 9

Balance Sheet of A Ltd. is given below:

| Liabilities | Rs. | Assets | Rs. |

| Share Capital | 800,000 | Building | 1200,000 |

| 15% Debentures | 400,000 | Machinery | 240,000 |

| Profit & Loss A/C (Current Year) | 600,000 | Debtors | 1300,000 |

| General Reserve | 600,000 | Stock | 700,000 |

| Current Liabilities | 11,60,000 | Bank | 120,000 |

| 35,60,000 | 35,60,000 |

Net Sales for the current year Rs. 5760,000

Compute:

- Net Profit Ratio

- Current Ratio

- Fixed Assets Turnover Ratio

- Debt-Equity Ratio

- Stock Turnover Ratio

- Debtors Turnover Ratio

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

Working 1: Current Assets = Debtors + Stock + Bank = 1300,000 + 700,000 + 120,000=21,20,000

Working 2: Fixed Assets = Building + Machinery = 12,00,000 + 240,000 = 14,40,000

| Working 3: Long Term Fund | Rs. |

| Share Capital | 800,000 |

| Profit & Loss A/C (Cr.) | 600,000 |

| General Reserve | 600,000 |

| Total Long Term Funds | 20,00,000 |

Working 3: Long Term Funds = Share Capital + General Reserve + P&L=800,000+600,000+600,000=20

Problem Question 10

From the following information calculate for both Companies:

- Gross Profit Ratio

- Working Capital Ratio

- Stock Turnover Ratio

- Liquid Ratio

| X Ltd. | Y Ltd. | |

| Sales | 25,20,000 | 21,40,000 |

| Cost of Sales | 19,20,000 | 16,35,000 |

| Opening Stock | 300,000 | 275,000 |

| Closing Stock | 500,000 | 350,000 |

| Other Current Assets | 760,000 | 640,000 |

| Fixed Assets | 14,40,000 | 1600,000 |

| Net Worth | 1500,000 | 14,00,000 |

| Debts (Long Term) | 900,000 | 950,000 |

| Current Liabilities | 600,000 | 665,000 |

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

| Working 1: Gross Profit | ||

| X Ltd. | Y Ltd. | |

| Sales | 25,20,000 | 21,40,000 |

| Less Cost of Sales | (19,20,000) | (16,35,000) |

| 600,000 | 505000 | |

| Working 2: Current Assets | ||

| X Ltd. | Y Ltd. | |

| Closing Stock | 500,000 | 350,000 |

| Add: Other Current Assets | 760,000 | 640,000 |

| 1260,000 | 990,000 | |

![]()

![]()

Problem Question 11

From the following figures extracted from Income Statement and Balance Sheet of Messers M.A & Sons Pvt. Ltd; Calculate:

- Gross Profit Ratio

- Net Profit Ratio

- Return on Capital Employed

- Return on Share Holders’ Fund

| Fixed Assets | 900,000 |

| Current Assets | 250,000 |

| Investment in Government Securities | 250,000 |

| Sales | 10,00,000 |

| Cost of Goods Sold | 505,000 |

| Operating Expenses | 100,000 |

| Share Capital | 600,000 |

| Reserves | 200,000 |

| 10% Debentures | 200,000 |

| Interest on Investment | 25,000 |

| Interest on Debentures | 20,000 |

Provision for Tax @40% of net profit

Solution:

![]()

![]()

![]()

![]()

| Working 1: Gross Profit | |

| Sales | 10,00,000 |

| Less Cost of Goods Sold | 505,000 |

| 495,000 | |

| Working 2: Net Profit | |

| Sales | 10,00,000 |

| Less Cost of Goods Sold | (505,000) |

| Gross Profit | 495,000 |

| Less Operating Expenses | (100,000) |

| Operating Profit | 395,000 |

| Add Interest on Investment | 25,000 |

| Less Interest on Debentures | (20,000) |

| Profit Before Tax | 400,000 |

| Tax @40% on Profit | (160,000) |

| Net Profit After Tax | 240,000 |

| Working 3: Net Capital Employed | |

| Current Assets | 250,000 |

| Less Current Liabilities(Tax) | (160,000) |

| Add Fixed Expenses | 900,000 |

| 990,000 | |

| Working 4: Share Holder’s Fund/Equity | |

| Share Capital | 600,000 |

| Add Reserve | 200,000 |

| Add Net Profit | 240,000 |

| 10,40,000 | |

Problem Question 12

The following data is taken from comparative balance sheet prepared for the Stanford Company:

| 2009 | 2010 | |

| Cash | 16,000 | 30,000 |

| Marketable Securities | 20,000 | 10,000 |

| Trade Receivables (net) | 45,000 | 55,000 |

| Inventories | 60,000 | 75,000 |

| Prepaid Expenses | 1500 | 2500 |

| Plant & Equipment (net) | 80,000 | 85,000 |

| Intangible Assets | 25,000 | 22500 |

| Other Assets | 5,000 | 6000 |

| 2,52,500 | 286,000 | |

| Current Liabilities | 60,000 | 100,000 |

(a) From the data given calculate for both years:

- The Working Capital

- The Current Ratio

- The Acid Test Ratio

- The ratio of current Assets to Total Assets

- The ratio of cash to current liabilities

(b) Evaluate each of the above changes

Solution:

![]()

![]()

![]()

Evaluation: Working Capital reduced by 10,000 due to increase in current liabilities.

![]()

![]()

Evaluation: Current ratio reduced (2.375 – 1.725) results negative impact

![]()

![]()

Evaluation: Acid Test ratio reduced (1.35 – 0.95) results negative impact

![]()

![]()

Evaluation: The ratio of current assets to total assets increased slightly (0.564 to 0.60) results positive impact.

![]()

![]()

Evaluation: The ratio of cash to current liabilities increased slightly (0.27 to 0.3) results positive impact.

| Working 1: Current Assets | ||

| 2009 | 2010 | |

| Cash | 16,000 | 30,000 |

| Marketable Securities | 20,000 | 10,000 |

| Trade Receivables (net) | 45,000 | 55,000 |

| Inventories | 60,000 | 75,000 |

| Prepaid Expenses | 1500 | 2500 |

| 142,500 | 172,500 | |

| Working 2: Quick/Liquid Assets | ||

| Quick/Liquid Assets | 2009 Rs. | 2010 Rs. |

| Current Assets | 142,500 | 172,500 |

| Less Stock | (60,000) | (75,000) |

| Less Prepaid Expenses | (1500) | (2500) |

| Quick/Liquid Assets | 81,000 | 95,000 |

You may also interested in following:

- Introduction to Statistics Basic Important Concepts

- Measures of Central Tendency, Arithmetic Mean, Median, Mode, Harmonic, Geometric Mean

- Correlation Coefficient

- How to calculate Net Present Value and Other Investment Criteria/Capital Budgeting Techniques

- Cambridge IGCSE/O Level Accounting: Topic 1: Fundamentals of Accounting & The Accounting Equation

- Cambridge IGCSE/O LEVEL Topic: 2 Sources and recording of data, Double Entry Book-keeping

- Material Costing, Specific Identification Method, Weighted Average Cost Method, First In, First Out Method(FIFO), Last In, Fist Out Method(LIFO)

- Material Costing, Economic Order Quantity EOQ, Reorder Point/Ordering Point, Lead Time, Maximum Level of Inventory, Minimum Level of Inventory, Average Stock Level, Safety Stock, Danger Level, Optimum number of Orders, Order Frequency

- Principles of Accounting, Journal, Ledger, Trial Balance

- Depreciation, Reasons of Depreciation, Methods of Depreciation, Straight Line/ Original Cost/Fixed Instalment Method, Diminishing/Declining/Reducing Balance Method.

- Consignment Account, Consignor or principal, Consignee or agent, Complete Analysis with Journal Entries, Theoretical Aspect, MCQ’s and Practical Examples

- Analysis of Accounting Ratios, Liquidity Ratios, Profitability Ratios, Solvency Ratios, Efficiency Ratios, Market Ratios, Return on Investment Ratios, Different Ratios and their Formulas, Practice Questions for Understanding