In this post, we are going to discuss Company Final Accounts, Trading Profit & Loss Account, Income Statement, Profit & Loss Appropriation Account, Statement of Financial Position or Balance Sheet, theoretically and practically with the help of practical examples. It is very important topic which is almost asked in every paper of company advanced final accounts just like consignment, Accounting Ratios, contract, departmental and branch accounting.

Table of Contents

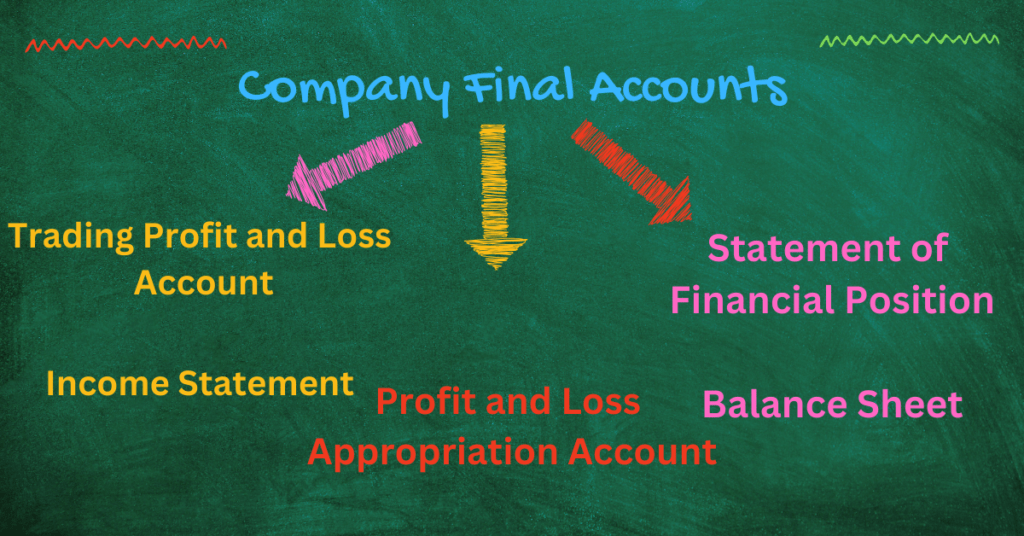

Company Final Accounts

Company final accounts are prepared at the end of the financial year. Under the modern accounting system, it is the composition of the Income statement, Profit & Loss Appropriation Account, and Statement of Financial Position whereas, under the classical approach, it is considered a Trading Profit and Loss Account, Profit & Loss Appropriation Account, and Balance Sheet. The income Statement and Trading Profit and Loss Account both tell us about the gross margin and net income of the business whereas the Statement of Financial Position and Balance sheet both tell us about the equality of Accounting Equation which is:

Assets = Liabilities + Capital

Under modern accounting system standards (IFRS International Financial Reporting Standards) Income Statement and Statement of Financial Position is considered.

Trading Profit & Loss Account

Trading Profit and Loss Account has two sections, the first one is called a trading account in which we take direct expenses and opening stock on the debit side whereas direct revenues and closing stock are on the credit side. There are three possibilities given below:

- If direct revenues are greater than direct expenses, the result is gross profit, which will be placed on the debit side.

- If direct revenues are less than direct expenses, the result is gross loss, which will be placed on the credit side of the account.

- If both direct expenses and direct revenues are equal, it means there is no profit no loss.

The Trading account calculates gross profit or gross loss which is the positive or negative difference of revenue that is directly collected after selling the product and the cost of sold products.

The second section is called the profit and loss account in which indirect expenses and gross loss are taken on the debit side whereas gross profit and indirect revenues are taken on the credit side of the account. The profit and loss account tells us that if the company gets profit after deducting indirect expenses from the gross profit and indirect revenues or not. There are also three possibilities given below:

- If indirect revenues are greater than indirect expenses and gross profit, the result is net profit, which will be placed on the debit side.

- If indirect revenues are less than indirect expenses and gross profit, the result is net loss, which will be placed on the credit side of the account.

- If both indirect expenses and indirect revenues are equal, it means there is no net profit and no net loss.

Income Statement

An income statement which consists of two sections:

• A trading section in which the gross profit or gross loss of the business is calculated

• A profit and loss section in which the profit or loss for the year of the business is calculated.

Gross profit = Selling price of goods – Cost of goods sold

Cost of Goods Sold = Beginning Inventory + Net Purchases – Closing inventory

Net Purchases = Purchases + Direct Expenses – Purchases return – Allowances or discounts – drawings

Note: Keep in mind that the above formula for the cost of goods sold is typically related to the trading business, not the manufacturing business.

After getting the gross margin or gross profit, we subtract all indirect expenses from the gross profit and add all indirect expenses to the gross profit, and the positive result is called net income or net profit and the negative outcome is considered as a net loss.

Profit & Loss Appropriation Account

Profit and Loss Appropriation accounts are prepared to know how much profit is left after the deduction of taxation provision, dividends, and reserves. Companies keep reserves out of profit as general reserve, contingency reserves, redemption reserve etc. On the other hand, companies also keep the amount out of profit for the provision of tax liabilities and offcourse for payment of announced dividends.

All the reserves, taxation provision and announced dividends given in adjustments are taken on the debit side of the account along with interim dividend given in trial balance whereas the net profit of the income statement or trading profit and loss account along with previous profit is taken on the credit side of the account. If there is profit left in the profit and loss appropriation account, it is transferred to the “Reserves” head on the liabilities side of the Balance sheet or Statement of Financial Position, alternatively, the case is reversed.

Statement of Financial Position or Balance Sheet

A statement of Financial Position or Balance Sheet has two Sections Assets and Liabilities including Capital. The equality of these both confirms the correctness of the records. Assets side following components:

Assets

There are different sub-heads under the head of Assets given below:

Fixed Long-term Assets

Fixed long-term assets are assets that are considered to be held by the company for more than one year and there is no intention to sell them immediately such as machinery, tools, plant, building, etc.

Deferred Costs

Deferred costs are those expenses that are paid in advance and will be realized or recognized as expenses over time such as technical know-how, preliminary expenses, etc.

Current Assets

Current assets are assets that can be converted into cash within one year such as cash, debtors, receivables, stock or inventory, prepaid expenses, accrued revenues, etc.

Liabilities and Capital

There are different sub-heads under the head of Liabilities and Capital given below:

Authorized Capital

Authorized capital is a capital amount that is authorized to accumulate by the registrar’s office to the company. It is only placed for information otherwise it is not considered while summing.

Issued, subscribed, and paid up Capital

Issued, subscribed, and paid-up capital is capital that is issued, people or investors subscribed and finally paid that capital amount to the company.

Reserves

Reserve head includes all reserves of the company that is taken out of the profit such as general, equalization, and redemption reserve along previous reserves. It includes premiums and profit from the profit & loss appropriation account also.

Long-term Liabilities

Long-term liabilities are liabilities that are expected to be paid after one year time period. Debentures and long-term loans are considered long-term liabilities.

Short-term liabilities

Short-term liabilities are liabilities that are expected to be paid within one one-year time period such as sundry creditors, accounts payable, outstanding expenses, taxation provisions, proposed dividends, etc.

Example Questions for Understanding

Example Question 1

The under mentioned balances appeared in the books of Saudi Co. Ltd. As on 31st December 2015

| Particulars | Rs. | Particulars | Rs. |

| Stocks | 172,058 | Authorized & Issued capital (60,000 shares of Rs. 100 each) | 600,000 |

| Book Debts | 223,380 | General Reserve | 250,000 |

| Investments | 288,950 | Unclaimed Dividend | 6,526 |

| Depreciation Reserve | 71,000 | Trade Creditors | 36,858 |

| Cash Balance | 72,240 | Buildings | 100,000 |

| Director’s Fee | 1800 | Purchases | 500,903 |

| Interim Dividend | 15,000 | Sales | 983,947 |

| Interest (Cr) | 8544 | Manufacturing Expenses | 359,000 |

| Profit & Loss Account 1-1-2015 | 16,848 | Establishment | 26,814 |

| Staff Provident Fund | 37,500 | General Charges | 31,078 |

| Machinery | 200,000 | ||

| Motor Vehicles | 15,000 | ||

| Furniture | 5000 |

From these balances and the following information Prepare the Company’s Balance Sheet as on 31st December 2015 and its Profit & Loss Account for the year ended on that date.

- The stock on 31st December was Valued at Rs. 148,680

- Provide Rs. 10,000 for Depreciation on Fixed Assets and Rs. 1500 for Company’s Contribution towards Staff provident Fund.

- Interest accrued on investment amount to Rs. 2,750.

- Establishment includes Rs. 6000 paid to the manager who is entitled to remuneration @ 5% of profit ascertained to a minimum of Rs. 10,000 p.a.

Required: Make the Profit & Loss Account and Balance Sheet for the year 2015

The following data is related to Sara Sundus Company for the year 31st December. 2010

| Debit Balances | Rs. | Credit Balances | Rs. |

| Building | 175,000 | Authorized & Issued capital (60,000 shares of Rs. 100 each) | 600,000 |

| Purchases | 500,903 | General Reserve | 250,000 |

| Manufacturing Expenses | 202,800 | Unclaimed Dividend | 6,526 |

| Establishment Expenses | 36,814 | Trade Creditors | 36,858 |

| General Charges | 31,078 | Sales | 983,947 |

| Machinery | 200,000 | Depreciation Reserve | 71,000 |

| Motor vehicles | 95,000 | Interest on Investments | 8,544 |

| Furniture | 15,000 | Profit & Loss A/C 1st Jan, 2010 | 16,848 |

| Opening Stock | 172,058 | Staff Provident Fund | 37,500 |

| Book Debts | 148,380 | ||

| Investments | 288,950 | ||

| Cash | 72,240 | ||

| Director’s Fee | 18,000 | ||

| Interim Dividend | 45,000 | ||

| Repairs & Renewals | 10,000 | ||

| 20,11,223 | 20,11,223 |

Adjustments:

- The stock on 31st December 2010 was Valued at Rs. 148,680 (Market Value at Rs. 149,000).

- Provide Rs. 20,000 for Depreciation on Fixed Assets, Rs. 6,500 for manager Commission and Rs. 1500 for Company’s Contribution towards provident Fund.

- Interest accrued on investment amount to Rs. 2,750.

- A Provision for Rs. 30,000 is necessary for Taxation.

- Directors propose a final dividend of Rs. 45,000.

- Claim of Rs. 5,000 for workman compensation is disputed.

- Credit Sales of Rs. 1,600 were left unrecorded.

Required:

Prepare Trading and Profit& loss Account and Balance Sheet.

Solution

| Sara Sundus Company | |||

| Trading Profit & Loss A/C | |||

| For the Year Ended 31st December 2010 | |||

| Opening Stock | 172,058 | Sales 983,947 | |

| Purchases | 500,903 | Add Sales Unrecorded 1600 | 985,547 |

| Manufacturing Expenses | 202,800 | Closing Stock | 148,680 |

| Gross Profit c/d | 258,466 | ||

| 1,134,227 | 1,134,227 | ||

| Establishment Expenses | 36,814 | Gross Profit b/d | 258,466 |

| General Charges | 31,078 | Interest on Investments 8,544 | |

| Director’s Fee | 18,000 | Add Accrued Interest 2,750 | 11,294 |

| Repairs & Renewals | 10,000 | ||

| Manager’s Commission | 6,500 | ||

| Depreciation | 20,000 | ||

| Contribution to Provident Fund | 1,500 | ||

| Net Profit Transferred to Profit & Loss Appropriation A/C | 145,868 | ||

| 269,760 | 269,760 | ||

| Profit & Loss Appropriation Account | |||

| Particulars | Amount | Particulars | Amount |

| Provision for Taxation | 30,000 | Previous Year Profit & Loss Account | 16,848 |

| Proposed Dividend | 45,000 | Net Profit for the Year 2010 | 145,868 |

| Interim Dividend | 45,000 | ||

| Balance Transferred to Balance Sheet | 42,716 | ||

| 162,716 | 162,716 | ||

| Sara Sundus Company | |||

| Balance Sheet | |||

| As on 31st December 2010 | |||

| Liabilities | Amount | Assets | Amount |

| Authorized Capital: | 0 | Fixed Assets: | |

| Issued, Subscribed & Paid up Capital | 600,000 | Building 175,000 | |

| Reserves: | Machinery 200,000 | ||

| Profit & Loss Appropriation A/C | 42,716 | Motor vehicles 95,000 | |

| General Reserve | 250,000 | Furniture 15,000 | |

| Less Depreciation Reserve (71,000) | |||

| Less Current Year’s Dep. (20,000) | 394,000 | ||

| Debentures & Long Term Liabilities: | Deferred Costs: | ||

| Current Liabilities: | Current Assets: | ||

| Proposed Dividend | 45,000 | Investment | 288,950 |

| Trade Creditors | 36,858 | Accrued Interest on Investment | 2,750 |

| Provision for Taxation | 30,000 | Cash | 72,240 |

| Unclaimed Dividend | 6,526 | Closing Stock | 148,680 |

| Commission for Manager | 6,500 | Book Debts 148,380 | |

| Provident Fund 37,500 | Add Sales Unrecorded 16,00 | 149,980 | |

| Add Contribution 15,00 | 39,000 | ||

| 1,056,600 | 1,056,600 | ||

Example Question 2

Usman Munir & Company, Sargodha with an authorized capital of Rs. 10,00,000 divided into 100,000 shares of Rs. 10 each. On 31st December 2012, 50,000 shares were fully called and paid up. The following are the balances taken, from the ledger of the company at 31st December, 2012.

| Particulars | Rs. | Particulars | Rs. |

| Stock | 100,000 | Printing & Stationary | 4800 |

| Sales | 850,000 | Advertising | 7600 |

| Purchases | 600,000 | Postage, telephones etc. | 21000 |

| Wages | 140,000 | Debtors | 77400 |

| Discount Allowed | 8400 | Creditors | 70400 |

| Discount Received | 6300 | Plant & machinery | 161000 |

| Insurance upto 30th June, 2013 | 13440 | Furniture | 34000 |

| Salaries | 37000 | Cash at bank | 279600 |

| Rent | 12000 | General Reserve | 50000 |

| General Expenses | 17900 | Loan from managing Director | 31400 |

| Profit & Loss A/C (Cr.) | 12440 | Bad debts | 6400 |

Additional Information

(1) Closing stock Rs. 200,000.

(2) Depreciation to be charge on plant and machinery 15% p.a and furniture at the rate of 10% p.a.

(3) Outstanding expenses: Wages Rs. 10,400, Salary Rs. 2,400 and Rent Rs. 1,200.

(4) Dividend at 5% on paid up share capital to be provided.

Required

Prepare trading and profit and loss account for the year ended 31st December 2012 and also a balance sheet as at that time.

Solution:

| Usman Munir & Company | |||

| Trading Profit & Loss A/C | |||

| For the Year Ended 31st December 2012 | |||

| Opening Stock | 100000 | Closing Stock | 200000 |

| Purchases | 600000 | Sales | 850000 |

| Wages 140000 | |||

| Add Outstanding 10400 | 150400 | ||

| Gross Profit c/d | 199600 | ||

| 1050000 | 1050000 | ||

| Discount Allowed | 8400 | Gross Profit b/d | 199600 |

| Insurance 13440 | Discount Received | 6300 | |

| Less Prepaid (6720) | 6720 | ||

| Salaries 37000 | |||

| Add Outstanding 2400 | 39400 | ||

| Rent 12000 | |||

| Add Outstanding 1200 | 13200 | ||

| General Expenses | 17900 | ||

| Depreciation on Plant & Machinery | |||

| (161000 x 0.15) | 24150 | ||

| Depreciation on Furniture | |||

| (34000 x 0.10) | 3400 | ||

| Bad Debts | 6400 | ||

| Printing & Stationary | 4800 | ||

| Advertising | 7600 | ||

| Postage, telephones etc. | 21000 | ||

| Net Profit Transferred to Profit & Loss Appropriation A/C | 52930 | ||

| 205900 | 205900 | ||

| Profit & Loss Appropriation Account | |||

| Particulars | Amount | Particulars | Amount |

| Proposed Dividend | Previous Year Profit & Loss | 12440 | |

| (500,000 x 0.05) | 25000 | Net Profit for the Year 2012 | 52930 |

| Balance Transferred to Balance Sheet | 40370 | ||

| 65370 | 65370 | ||

| Usman Munir & Company | |||

| Balance Sheet | |||

| As on 31st December 2012 | |||

| Liabilities | Amount | Assets | Amount |

| Authorized Capital: | 1000000 | Fixed Assets: | |

| Issued, Subscribed & Paid up Capital | Furniture Less Depreciation | ||

| (50,000 shares of Rs. 10 each) | 500000 | (34000 – 3400) | 30600 |

| Reserves: | Plant & Machinery Less Depreciation | ||

| Profit & Loss Appropriation A/C | 40370 | (161,000 – 24150) | 136850 |

| General Reserve | 50000 | ||

| Debentures & Long Term Liabilities: | |||

| Nil | 0 | Deferred Costs: | |

| Current Liabilities: | Nil | 0 | |

| Sundry Creditors | 70400 | ||

| Loan from managing director | 31400 | Current Assets: | |

| Proposed Dividend | 25000 | Cash at bank | 279600 |

| Outstanding Wages | 10400 | Closing Stock | 200000 |

| Outstanding Salaries | 2400 | Prepaid Insurance | 6720 |

| Outstanding Rent | 1200 | Sundry Debtors | 77400 |

| 731170 | 731170 | ||

Example Question 3

Luqman Auto Part Company has authorized capital of Rs. 500,000 divided into 50,000 shares of Rs. 10 each, of which 20,000 shares had been issued and fully paid. The following Trial balance is extracted on 31st December 2010.

| Particulars | Debit | Credit |

| Stock on Jan. 1, 2010 | 93,210 | |

| Returns | 6340 | 4925 |

| Sundry Manufacturing Expenses | 19620 | |

| 9% Bank loan | 25000 | |

| Office Salaries and Expenses | 34500 | |

| Director’s Remuneration | 13,230 | |

| Freehold Premises | 98,000 | |

| Furniture | 7500 | |

| Cash in hand | 1240 | |

| Profit & loss Account | 19320 | |

| Investment | 24000 | |

| Debtors | 52,700 | |

| Share capital | 200,000 | |

| Purchases & Sales | 359105 | 584750 |

| Creditors | 31110 | |

| Carriage | 2450 | |

| Clearing Charges | 12500 | |

| Interest on Bank Loan | 1125 | |

| Auditor Fee | 11620 | |

| Preliminary Expenses | 9000 | |

| Plant & Machinery | 74200 | |

| Cash at bank | 9765 | |

| Advanced Income Tax Paid | 35,000 | |

| 865,105 | 865,105 |

Adjustments:

- On 31st December 2010 Closing Stock valued at Rs. 64,240.

- Outstanding Wages Rs. 1380 while Office Salaries Rs. 1500 are still payable.

- Depreciation on Plant & Machinery is to be provided @15% and on furniture is to be 10%.

- Market Value of Investment on 31-12-2010 is Rs. 25,000.

- Directors Recommended the following:

- Provision for Income Tax @ 30% of Net Profit

- Dividend @ 15% to the shareholders on paid up share capital.

- Transfer to General Reserve Rs. 10,000.

Required:

Prepare Trading & Profit & loss Account for the year ended 31st Dec. 2010 and balance sheet as at that date.

Solution:

| Luqman Auto Part Company | |||

| Trading Profit & Loss A/C | |||

| For the Year Ended 31st December 2010 | |||

| Opening Stock | 93,210 | Closing Stock | 64,240 |

| Purchases 359105 | Sales 584750 | ||

| Less Returns (4925) | 354180 | Less Returns (6340) | 578,410 |

| Sundry Manufacturing Expenses 19620 | |||

| Add Outstanding 1380 | 21,000 | ||

| Carriage | 2450 | ||

| Clearing Charges | 12500 | ||

| Gross Profit C/d | 159,310 | ||

| 642,650 | 642,650 | ||

| Office Salaries & Expenses 34500 | Gross Profit b/d | 159,310 | |

| Add Outstanding 1500 | 36000 | ||

| Depreciation on Plant & Machinery | |||

| (74200 x x0.15) | 11,130 | ||

| Depreciation on Furniture | |||

| (7500 x 0.10) | 750 | ||

| Auditor Fee | 11620 | ||

| Interest on bank Loan 1125 | |||

| Add Outstanding 1125 | 2250 | ||

| (25000 x 0.09)=2250 | |||

| Director’s Remuneration | 13,230 | ||

| Net Profit Transferred to Profit & Loss Appropriation A/C | 84,330 | ||

| 159,310 | 159,310 | ||

| Profit & Loss Appropriation Account | |||

| Particulars | Amount | Particulars | Amount |

| Transfer to General reserve | 10,000 | Previous Year Profit & Loss Account | 19,320 |

| Provision for Taxation (84330 x 0.30) | 25,299 | Net Profit for the Year 2010 | 84,330 |

| Proposed Dividend | |||

| (200,000 x 0.15) | 30,000 | ||

| Balance Transferred to Balance Sheet | 38,351 | ||

| 103,650 | 103,650 | ||

| Luqman Auto Part Company | |||

| Balance Sheet | |||

| As on 31st December 2010 | |||

| Liabilities | Amount | Assets | Amount |

| Authorized Capital: | 500,000 | Fixed Assets: | |

| Issued, Subscribed & Paid up Capital | 200,000 | Plant & Machinery less Depreciation | |

| Reserves: | (74200 – 11130) | 63,070 | |

| Profit & Loss Appropriation A/C | 38,351 | Furniture Less Depreciation | |

| General Reserve | 10,000 | (7500 – 750) | 6,750 |

| Freehold Premises | 98,000 | ||

| Deferred Costs: | |||

| Debentures & Long Term Liabilities: | Preliminary Expenses | 9000 | |

| 9% Bank Loan | 25,000 | ||

| Current Liabilities: | Current Assets: | ||

| Wages Payable | 1380 | Investment | 24,000 |

| Office Salaries Payable | 1500 | Closing Stock | 64,240 |

| Proposed Dividend | 30000 | Cash at Bank | 9765 |

| Interest Payable on Bank Loan | 1,125 | Cash in hand | 1240 |

| Sundry Creditors | 31,110 | Sundry Debtors | 52,700 |

| Provision for Taxation | 25,299 | Advanced Income Tax Paid | 35,000 |

| 363,765 | 363,765 | ||

Example Question 4

From the following Trial Balance of Mehran Public Limited Company, prepare Company’s Final Account.

| Debit Balances | Rs. | Credit Balances | Rs. |

| Stock | 15140 | Share Capital: | |

| Purchases | 32240 | 10,000 shares of Rs. 10 each | 100,000 |

| Rent | 22000 | Sales | 135,000 |

| Wages & salaries | 8200 | General Reserves | 10,000 |

| Investment | 48000 | Creditors | 4000 |

| Plant & Machinery | 16000 | Bills Payable | 5000 |

| Debtors | 28000 | Income from Investment | 1400 |

| Bills Receivable | 2000 | Profit & Loss Account | 13,500 |

| Cash | 9560 | Purchases Returns | 2240 |

| Land & Building | 90000 | ||

| 271140 | 271140 |

Adjustments:

- Closing Stock Rs. 20,000

- Taxation Provision required for the year Rs. 6000.

- Transfer Rs. 2000 to General Reserve.

- Plant & Machinery is to be depreciated @5% p.a.

- Proposed dividend @ 5%

- Create provision for bad debts @5%.

Solution:

| Mehran Public Limited Company | |||

| Trading Profit & Loss A/C | |||

| For the Year Ended 31st December XXXX | |||

| Opening Stock | 15140 | Closing Stock | 20,000 |

| Purchases 32240 | Sales | 135,000 | |

| Less Returns (2240) | 30,000 | ||

| Wages & salaries | 8200 | ||

| Gross Profit C/d | 101,660 | ||

| 155,000 | 155,000 | ||

| Rent | 22000 | Gross Profit b/d | 101,660 |

| Depreciation on Plant & Machinery | Income from Investment | 1400 | |

| (16,000 x x0.05) | 800 | ||

| Bad Debts 0 | |||

| Add Write Off 0 | |||

| Add New Provision: | |||

| (28,000 x 0.05) 1400 | |||

| Less Old Provision (0) | 1400 | ||

| Net Profit Transferred to Profit & Loss Appropriation A/C | 78,860 | ||

| 103,060 | 103,060 | ||

| Profit & Loss Appropriation Account | |||

| Particulars | Amount | Particulars | Amount |

| Transfer to General reserve | 2,000 | Previous Profit & Loss Account | 13,500 |

| Provision for Taxation | 6,000 | Net Profit for the Year 2010 | 78,860 |

| Proposed Dividend | |||

| (100,000 x 0.05) | 5,000 | ||

| Balance Transferred to Balance Sheet | 79,360 | ||

| 92,360 | 92,360 | ||

| Mehran Public Limited Company | |||

| Balance Sheet | |||

| As on 31st December XXXX | |||

| Liabilities | Amount | Assets | Amount |

| Authorized Capital: | Fixed Assets: | ||

| Issued, Subscribed & Paid up Capital | 100,000 | Plant & Machinery less Depreciation | |

| Reserves: | (16,000 – 800) | 15,200 | |

| Profit & Loss Appropriation A/C | 79,360 | Land & Building | 90000 |

| General Reserve 10,000 | Deferred Costs: | 0 | |

| Add Transfer 2,000 | 12,000 | Current Assets: | |

| Investment | 48,000 | ||

| Debentures & Long Term Liabilities: | 0 | Closing Stock | 20,000 |

| Bills Receivable | 2000 | ||

| Current Liabilities: | Cash | 9560 | |

| Creditors | 4000 | Sundry Debtors 28,000 | |

| Bills Payable | 5000 | Less Write off (0) | |

| Proposed Dividend | 5000 | Less New Provision (1400) | 26,600 |

| Provision for Taxation | 6,000 | ||

| 211,360 | 211,360 | ||

Example Question 5

The following is the Trial balance of Sony Company Limited for the year ending December, 31st 2014.

| Particulars | Debit | Credit |

| Salaries & Wages | 136200 | |

| Carriage Outward | 23200 | |

| Interim Dividend | 48000 | |

| Equity Share Capital | 700000 | |

| Balance from Trading Account | 353100 | |

| Technical Know how | 36000 | |

| Closing Stock | 566,000 | |

| Furniture | 140000 | |

| Profit & Loss A/c | 148500 | |

| Freehold Property | 400,000 | |

| Share Premium Account | 80,000 | |

| Cash in Hand | 30,000 | |

| Debtors | 230,000 | |

| 9% Debentures | 200,000 | |

| General Reserve | 56,000 | |

| Bills Receivable | 24,000 | |

| Debentures interest | 9000 | |

| Creditors | 100800 | |

| Bills Payable | 24,000 | |

| Transfer to General Reserve | 20,000 | |

| 1662400 | 1662400 |

Adjustments:

- Sony Company has an authorized capital of Rs. 12,00,000 divided into ordinary share of Rs. 10 each. The Company has issued 70,000 shares which are fully paid.

- Depreciation is to be provided @10% on furniture and property.

- Credit sales of Rs. 6900 were left unrecorded.

- Create Provision for bad and doubtful debts @3% on debtors.

- The directors proposed the following:

- Provision for Taxation 60,000

- 4% proposed dividend.

Required:

Prepare Profit & Loss account and Balance sheet for the year ended 31st December, 2014.

Solution:

| Sony Company Limited | |||

| Trading Profit & Loss A/C | |||

| For the Year Ended 31st December 2014 | |||

| Salaries & Wages | 136,200 | Gross Profit 353100 | |

| Carriage Outward | 23,200 | Credit Sales Unrecorded 6900 | 360,000 |

| Interest on Debentures 9000 | |||

| (200,000 x 0.09)=18000 | |||

| Add Outstanding 9000 – 4500 9000 | 18000 | ||

| Bad Debts 0 | |||

| Add Write Off 0 | |||

| Add New Provision | |||

| (230,000 + 6900) x 0.04) 7107 | |||

| Less Old Provision (0) | 7107 | ||

| Depreciation on Furniture | |||

| (140,000 x 0.10) | 14000 | ||

| Depreciation on Property | |||

| (400,000 x 0.10) | 40,000 | ||

| Net Profit Transferred to Profit & Loss Appropriation A/C | 121,493 | ||

| 360,000 | 360,000 | ||

| Profit & Loss Appropriation Account | |||

| Particulars | Amount | Particulars | Amount |

| Transfer to General reserve | 20,000 | Previous Year Profit & Loss Account | 148,500 |

| Provision for Taxation | 60,000 | Net Profit for the Year 2010 | 121,493 |

| Proposed Dividend | |||

| (700,000 x 0.05) | 35000 | ||

| Interim Dividend | 48,000 | ||

| Balance Transferred to Balance Sheet | 106,993 | ||

| 269,993 | 269,993 | ||

| Sony Company Ltd. | |||

| Balance Sheet | |||

| As on 31st December 2014 | |||

| Liabilities | Amount | Assets | Amount |

| Authorized Capital: | 1200,000 | Fixed Assets: | |

| Issued, Subscribed & Paid up Capital | 700,000 | Freehold Property less Depreciation | |

| Reserves: | (400,000 – 40000) | 360,000 | |

| Profit & Loss Appropriation A/C | 106,993 | Furniture Less Depreciation | |

| General Reserve 36,000 | (140,000 – 14000) | 126,000 | |

| Add Transfer to General Reserve 20,000 | 56,000 | ||

| Share Premium | 80,000 | Deferred Costs: | |

| Debentures & Long Term Liabilities: | Technical Knowhow | 36000 | |

| 9% Debentures | 200,000 | ||

| Current Liabilities: | Current Assets: | ||

| Bills Payable | 24,000 | ||

| Interest on debentures Payable | 9000 | Closing Stock | 566,000 |

| Proposed Dividend | 35000 | Bills Receivable | 24000 |

| Provision for Taxation | 60,000 | Cash in hand | 30000 |

| Sundry Creditors | 100,800 | Sundry Debtors 230,000 | |

| Add Credit Sales Unrecorded 6900 | |||

| Less Write Off (0) | |||

| Less New Provision (7107) | 229,793 | ||

| 1371,793 | 1371,793 | ||

You may also interested in the following:

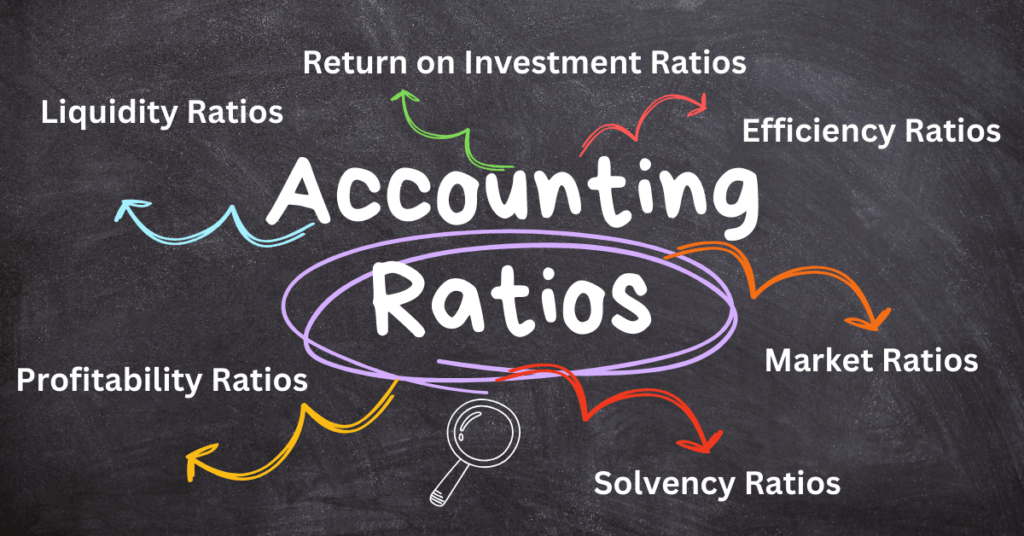

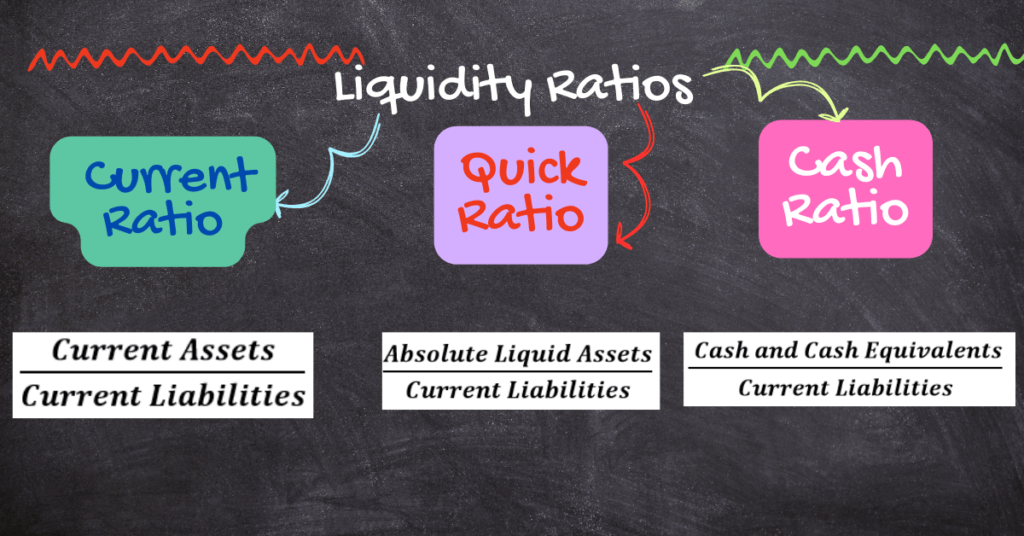

- 5. Analysis of Accounting Ratios, Liquidity Ratios, Profitability Ratios, Solvency Ratios, Efficiency Ratios, Market Ratios, Return on Investment Ratios, Different Ratios and their Formulas, Practice Questions for Understanding

- 5.1 Analysis of Accounting Ratios, Exercise Problem Questions & their solutions

- 8. Consignment Account, Consignor or principal, Consignee or agent, Complete Analysis with Journal Entries, Theoretical Aspect, MCQ’s and Practical Examples

- Material Costing, Specific Identification Method, Weighted Average Cost Method, First In, First Out Method(FIFO), Last In, Fist Out Method(LIFO)

- Material Costing, Economic Order Quantity EOQ, Reorder Point/Ordering Point, Lead Time, Maximum Level of Inventory, Minimum Level of Inventory, Average Stock Level, Safety Stock, Danger Level, Optimum number of Orders, Order Frequency