“The Business Cycle and Its Phases” provides an insightful overview of the recurring economic fluctuations that economies experience over time. This blog post explores the four key phases—expansion, peak, contraction, and trough—shedding light on their characteristics, causes, and effects on businesses, consumers, and the economy as a whole. Perfect for business and finance students, this post breaks down complex economic concepts into easy-to-understand insights. This topic is equally important for the students of economics across all the major Boards and Universities such as FBISE, BISERWP, BISELHR, MU, DU, PU, NCERT, CBSE & others & across all the business & finance disciplines.

Table of Contents

The Business Cycle and Its Phases

Introduction of Business or Trade Cycle

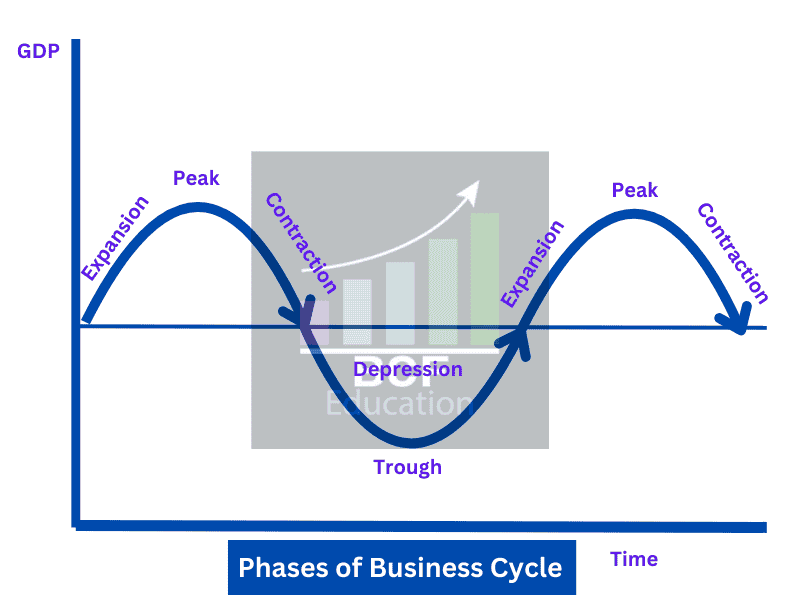

Business or Trade Cycle is multi-phased phenomenon in which economy experiences different variations in the economic activity. These variations or phases represents the upward and downward movements of the economy or we can say expansion and contraction of the economy. These movements can be identified through different macroeconomic indicators such as GDP (Gross Domestic Product), Productivity, employment level etc.

Key Definitions by Economists

- John Maynard Keynes

Keynes defined the business cycle as:

“A business cycle is composed of periods of good trade characterized by rising prices and low unemployment, followed by periods of bad trade with falling prices and high unemployment.” - Alvin Hansen

Hansen described the business cycle as:

“The business cycle consists of alternate expansions and contractions in aggregate economic activity that occur in all sectors and are not limited to a specific area or region.” - Arthur Pigou

Pigou explained the trade cycle as:

“The business cycle is characterized by alternating periods of prosperity and depression. These cycles are driven by changes in the business optimism or pessimism of entrepreneurs.” - Wesley Mitchell

Mitchell focused on its practical manifestations, stating:

“Business cycles are a complex phenomenon of fluctuations in economic activities such as production, trade, and employment over a period of years.”

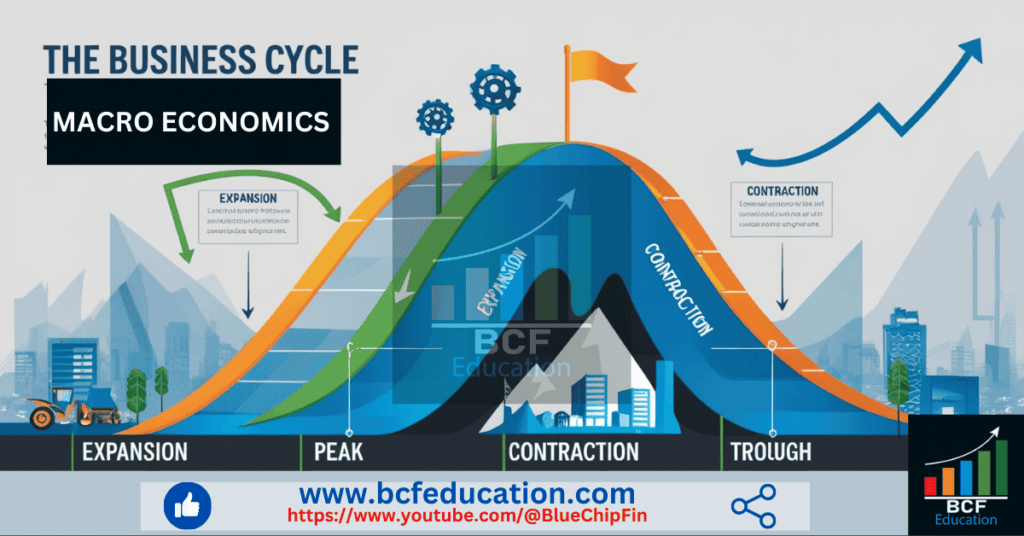

Phases of the Business Cycle

The business cycle consists of four key phases:

1. Expansion (Prosperity Phase)

Expansionary or prosperity phase represents the expansion of the economy and it can be identified through key macroeconomic indicators such as GDP, Employment, Productivity and Consumer Spending. Its key features are given below:

Features:

- Increased production

- Increased Investment.

- Higher business profits.

- Increasing employment opportunities

- Rising wages

- Rising Consumer spending and confidence.

2. Peak

Peak is the second stage which represents that economy is fully saturated and there is no more room to fulfill. This stage can be identified through following features:

Features:

- High production and demand.

- Full or near-full employment.

- Overutilization of resources

- Inflation due to overutilization of resources.

3. Contraction (Recession Phase)

Contraction or recession is the third phase of business cycle in which economy turns to contract or squeeze after peak. In this phase consumer demand declines, productivity falls. It can be identified through key macroeconomic indicators such as GDP, Employment, Productivity and Consumer Spending. Its key features are given below:

- Features:

- GDP declines.

- Production declines

- Rising unemployment.

- Consumer spending declines.

- Business and Consumer confidence both declines.

4. Trough (Depression Phase)

Trough is the lowest phase of recession in which recession experiences its worst, economy is weakest. It can also be identified through negative GDP, worst unemployment etc. Its features are given below:

Features:

- Drastic decline in production.

- Unemployment is at its worst.

- Deflation due to negative consumer confidence.

- Negative GDP growth

- No investments

- No Business Confidence

5. Recovery

Finally economy bounce back after hitting the trough and starting regain the consumer and business confidence due to improvements and corrective measures of the economy. It can also be identified through GDP, employment level and other macro measures. Features of recovery are given below:

Features:

- Negative GDP turning positive

- Gaining consumer confidence

- Gaining business confidence

- Reduction in unemployment rates

- Gradual increase in Production

- Gradual increase in prices

- consumer’s income gradually rising

Summary

The business cycle represents the natural rhythm of economic highs and lows in any economy. The phases of expansion, peak, contraction, and trough demonstrate how economies periodically grow and slow down. Leading economists, like Keynes and Hansen, have provided valuable insights into its causes, emphasizing the role of investment, innovation, and aggregate demand. Understanding business cycles helps policymakers implement strategies to stabilize economies and mitigate extreme fluctuations.

Related Articles

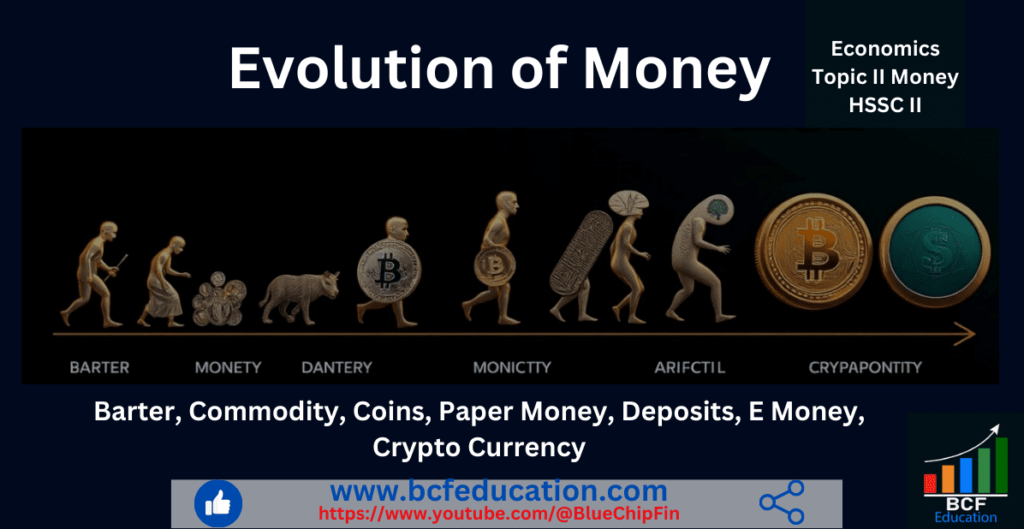

Money, Barter System and its Difficulties