“Investment Analysis, Risk-Return Trade-Off, Investment Decision Process” is a comprehensive guide tailored for students and aspiring investors worldwide. This post delves into the core principles of investment analysis, exploring how to evaluate potential investment opportunities and make informed decisions. A key focus is on the risk-return trade-off, a fundamental concept that highlights the balance between the potential rewards of an investment and the level of risk involved.

Additionally, the blog breaks down the investment decision process, providing a step-by-step framework to help readers navigate the complexities of portfolio management. Whether you’re a finance student, a budding investor, or simply curious about the world of investments, this post offers valuable insights and practical knowledge to enhance your understanding of these critical topics. Perfect for learners across all universities, this guide is your gateway to mastering the art and science of investment analysis and portfolio management.

This description is concise, informative, and designed to attract readers by addressing their pain points and offering actionable solutions. This topic is equally important for the students of the subject Human Resource Management across all the major Universities such as MU, DU, PU & others & across all business & finance disciplines.

Table of Contents

INVESTMENT ANALYSIS, RISK RETURN TRADE-OFF, INVESTMENT DECISION PROCESS

What is an Investment?

An investment is when you commit money or resources now with the hope of gaining benefits in the future. For example, someone might buy shares of a company’s stock, hoping that the value of those shares will grow over time, making the wait and the risk worth it. Investing means putting your resources (like money) into something with the goal of earning more money or seeing its value increase over time. This can include things like stocks, bonds, or even physical assets like real estate. Investing is a key part of managing your finances, whether for personal or professional goals, and it helps you build wealth and achieve your financial dreams.

Real Assets vs. Financial Assets

A society’s wealth depends on its ability to produce goods and services. This ability comes from real assets—things like land, buildings, machinery, and knowledge that are used to create products or services.

On the other hand, financial assets are things like stocks and bonds. These aren’t physical objects (they’re often just digital records), and they don’t directly contribute to producing goods or services. Instead, they represent ownership or claims on real assets. For example, if you can’t own a car factory (a real asset), you can buy shares in a company like Ford or Toyota (financial assets). This lets you share in the profits those companies make from producing cars.

While real assets create income for the economy, financial assets determine how that income or wealth is divided among investors. People can choose to spend their money now or invest it for the future. If they invest, they might buy financial assets like stocks or bonds. Companies then use that money to buy real assets, like equipment or technology. In the end, the returns investors earn from financial assets come from the income generated by the real assets those companies own.

Why Should You Learn About Investing?

Learning about investments is important for a few key reasons:

Growing Your Money: At some point, most people invest—whether it’s through retirement savings, buying property, or other ways. Understanding how investing works helps you make smarter decisions with your money, so you can grow your wealth over time.

Career Opportunities: If you’re interested in a job in finance, knowing about investments is a must. Jobs like financial analysts, portfolio managers, financial advisors, and other finance roles require strong knowledge of how investments and markets work.

Investment Decisions: The Tradeoff Between Expected Return and Risk

The Basics of Investing: Risk and Return

A key idea in investing is the balance between expected return and risk:

Expected Return vs. Actual Return: The “expected return” is the profit you hope to make from an investment. However, the actual return you get might be different because of changes in the market or unexpected events.

Risk: Risk is the chance that your actual return won’t match what you expected. Things like market ups and downs, the economy, and the type of investment you choose can all affect risk.

Investors need to think about their risk tolerance—how much risk they’re comfortable taking and how much they can handle. Usually, investments with the potential for higher returns also come with higher risks. Finding the right balance between risk and return is important to match your investments with your financial goals and comfort level.

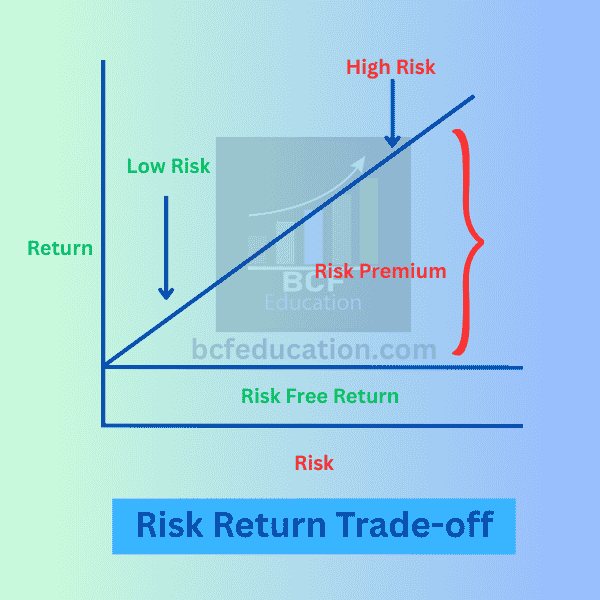

Risk-Return Trade-off

If everything else were equal, everyone would want investments with the highest possible returns. But in the real world, there’s no free lunch. If you want the chance to earn higher returns, you’ll have to take on more risk.

Here’s why: If an investment offered high returns without extra risk, everyone would rush to buy it. This would drive up its price, making it less attractive because the expected return (profit per dollar invested) would go down. The price would keep rising until the expected return matches the level of risk. At that point, the investment would offer a “fair” return for the risk involved—but no more.

On the flip side, if returns didn’t depend on risk at all, people would sell risky investments. Their prices would drop, making their expected returns rise until they became attractive again. This is why, in the market, riskier investments are priced to offer higher expected returns than safer ones.

Unanswered Questions and Diversification

This raises some big questions: How do you measure risk? What’s the right balance between risk and return? While risk is often linked to how much an investment’s returns go up and down (its volatility), that’s only part of the story.

When you build a diversified portfolio (a mix of different investments), you need to think about how those investments work together. Diversification means spreading your money across many assets so you’re not too exposed to any single one. This reduces the overall risk of your portfolio.

The study of how diversification affects risk, how to measure risk properly, and the relationship between risk and return is called modern portfolio theory. This theory was so groundbreaking that its creators, Harry Markowitz and William Sharpe, won Nobel Prizes for their work.

Why This Matters

Learning about investments helps you make smarter decisions to grow your wealth. By understanding the tradeoff between risk and return, you can create strategies that match your goals while keeping potential downsides in check.

The Investment Decision Process

The investment decision process is a step-by-step method that helps investors choose and manage investments to reach their financial goals. It usually involves two main steps: security analysis and valuation, followed by portfolio management.

1. Security Analysis and Valuation

This first step is about studying individual investments (like stocks or bonds) to figure out their true value and whether they’re worth investing in. Key parts of this step include:

Understanding the Investment: Looking at things like a company’s financial health, its position in the market, and its growth potential to estimate what the investment is really worth.

Valuation Methods: Using tools like discounted cash flow analysis, price-to-earnings ratios, and other financial metrics to decide if an investment is overpriced, underpriced, or fairly priced.

2. Portfolio Management

After analyzing individual investments, the next step is building and managing a portfolio—a mix of investments designed to meet your financial goals. This involves:

Thinking of Investments as a Group: Considering how different investments work together to balance risk and return.

Market Efficiency: Understanding how quickly markets react to new information, which affects when and how you invest.

Adjusting the Portfolio: Deciding when to make changes based on market shifts, new information, or changes in your goals.

Measuring Performance: Using benchmarks and metrics to see if your portfolio is meeting your goals and delivering the returns you expect for the risks you’re taking.

What Affects the Investment Decision Process?

Several factors can impact how well the investment process works:

Uncertainty of Future Returns: Since no one can predict the future, investors rely on estimates, but actual results may differ.

International Investments: Investing in foreign assets can offer higher returns or diversify risk, but it also adds challenges like currency risk and geopolitical issues.

Changing Environments: Rapid shifts in the economy, technology, or regulations mean investors need to stay flexible and adapt quickly.

Technology: The internet and digital tools have made investing easier, providing real-time information and new ways to invest.

Big Players: Large investors like pension funds, mutual funds, and insurance companies can influence markets through their decisions, affecting prices and liquidity.

In Summary

The investment decision process is a detailed approach that involves analyzing individual investments and strategically managing a diversified portfolio. Investors need to consider factors like market uncertainty, global opportunities, technological changes, and the influence of big players to make the best decisions and achieve their financial goals.

Important Short Question and their Short Answers

Q1. What is an Investment?

An investment is the process of committing money or resources to an asset (like stocks, bonds, or real estate) with the goal of earning a profit or benefit in the future. It’s about putting your money to work today to grow it over time.

Q2. What are the Two Main Steps in Making Investment Decisions?

The investment decision process involves two key steps:

Security Analysis: This is about studying individual investments (like stocks or bonds) to figure out their true value and whether they’re worth buying. It’s a challenging task because it involves estimating what an investment is really worth.

Portfolio Management: After analyzing individual investments, you build a portfolio (a collection of investments). This step focuses on how all your investments work together to balance risk and return. A portfolio is more than just the sum of its parts—it’s about how everything fits together.

Q3. Is Studying Investments Important for Most People?

Yes! Learning about investments is crucial for most people because it helps them make smarter financial decisions. Understanding investments can lead to better financial security, help you plan for retirement, and achieve long-term goals like buying a home or funding education.

Teaching kids about investing early can also set them up for financial success later in life, helping them avoid debt and build wealth.

Q4. What’s the Difference Between a Financial Asset and a Real Asset?

Financial Asset: This is something like a stock or bond—it’s a piece of paper (or digital record) that represents a claim on something of value, like a company or government.

Real Asset: This is a physical thing, like gold, diamonds, or land. It’s tangible and can be touched.

Q5. What is the Risk-Return Tradeoff?

Investing is all about balancing risk and return. If you want the chance to earn higher returns, you’ll need to take on more risk. The risk-return tradeoff is like a slope: the higher the expected return, the higher the risk you’ll need to take.

The starting point for this tradeoff is the risk-free rate (like the return on government bonds), which is the safest return you can get without taking any risk.

Q6. Do Risk-Averse Investors Avoid Risk Completely?

No. Even risk-averse investors take on some risk, but they prefer safer investments like bonds or savings accounts. They aim to minimize risk, not eliminate it entirely.

Q7. What’s the Basic Nature of Investment Decisions?

Investment decisions are about balancing the tradeoff between expected return and risk. Every time you invest, you’re deciding how much risk you’re willing to take for the chance to earn a certain return.

Q8. What’s the Difference Between Expected Return and Realized Return?

Expected Return: This is the return you hope to earn from an investment, based on predictions and estimates. It’s not guaranteed.

Realized Return: This is the actual return you get after the investment period. It’s based on what really happened, not what you expected.

Q9. What is Risk? What Types of Risk Are There?

Risk is the chance that your investment won’t perform as expected. There are many types of risk, including:

Default Risk: The risk that a borrower won’t repay their debt.

Market Risk: The risk of losing money due to market fluctuations.

Interest Rate Risk: The risk that changes in interest rates will affect your investment.

Inflation Risk: The risk that inflation will reduce your returns.

Liquidity Risk: The risk that you won’t be able to sell your investment quickly.

Political Risk: The risk that political changes will hurt your investment.

Q10. What Constraints Do Investors Face Besides Risk?

Investors deal with other challenges, such as:

Time: How long they can invest.

Taxes: How taxes affect their returns.

Transaction Costs: Fees for buying and selling investments.

Income Needs: How much money they need from their investments.

Legal Rules: Regulations that affect how they can invest.

Diversification: The need to spread investments to reduce risk.

Q11. Are All Rational Investors Risk-Averse?

Yes, all rational investors are risk-averse to some degree. They won’t take on risk unless they expect to be rewarded for it. However, not all investors have the same level of risk tolerance—some are more comfortable with risk than others.

Q12. What is Risk Tolerance?

Risk tolerance is how much risk an investor is willing to take. It’s a key factor in deciding how to invest. Investors aim to maximize returns based on how much risk they’re comfortable with.

Q13. What External Factors Affect Investment Decisions?

The main external factors are:

Uncertainty: The unpredictability of markets.

Global Investing: Opportunities and risks in international markets.

The Internet: Access to real-time information and new investment tools.

Institutional Investors: Large investors like mutual funds and pension funds that influence markets.

Uncertainty is the most important factor because it’s always present in investing.

Q14. What Are Institutional Investors? How Do They Affect Individual Investors?

Institutional investors are big players like banks, pension funds, and mutual funds that manage large portfolios. They influence markets by buying and selling in huge amounts. While they have advantages like research teams, individual investors can still do well by staying informed and making smart decisions.

Q15. Why Do Corporate Bonds and Treasury Bonds Have Different Required Returns?

Corporate bonds are riskier than Treasury bonds (which are considered risk-free), so investors demand a higher return for taking on that extra risk.

Q16. Why Should U.S. Investors Consider International Investing?

International investing offers:

Diversification: Spreading risk across different economies.

Valuation Opportunities: Finding undervalued stocks in other markets.

Exposure to Different Economies: Benefiting from growth in other parts of the world.

Exchange rates can affect international investments, but they’re just one factor to consider.

Q17. What Are the Different Types of Investment Risks?

Key risks include:

Market Risk: The risk of market declines.

Interest Rate Risk: The risk of interest rate changes.

Inflation Risk: The risk of losing purchasing power.

Credit Risk: The risk of a borrower defaulting.

Liquidity Risk: The risk of not being able to sell quickly.

Currency Risk: The risk of exchange rate changes.

Business Risk: The risk of a company performing poorly.

Political Risk: The risk of political instability.

Q18. What’s the Difference Between Systematic and Unsystematic Risk?

Systematic Risk: This affects the entire market (like a recession) and can’t be avoided through diversification.

Unsystematic Risk: This is specific to a company or industry and can be reduced by diversifying your portfolio.

Q19. What’s the Difference Between Risk-Free Rate, Risk Premium, and Market Risk?

Risk-Free Rate: The return on a safe investment like government bonds.

Risk Premium: The extra return you expect for taking on risk.

Market Risk: The risk of the entire market declining.

Q20. What is Diversification?

Diversification is spreading your investments across different assets, industries, and regions to reduce risk. It helps balance your portfolio so that a loss in one area can be offset by gains in another. This strategy aims to provide more stable returns over time.