O Level Accounting

📚 O Level Accounting – Your Foundation to Financial Mastery 📚

Welcome to O Level Accounting – the ultimate resource for mastering the fundamentals of financial recording and reporting! Designed for students, teachers, and accounting enthusiasts, this page breaks down complex concepts into clear, exam-friendly lessons aligned with the O Level syllabus.

Key Topics Covered:

✅ Accounting Basics – Double-entry system, books of original entry, ledgers & trial balances

✅ Financial Statements – Income statements, balance sheets, and cash flow statements

✅ Depreciation & Adjustments – Straight-line vs. reducing balance methods, accruals/prepayments

✅ Control Systems – Bank reconciliations, control accounts, and error correction

✅ Ethical Accounting – Principles of transparency, consistency, and materiality

Why Choose This Resource?

✏️ Exam-Focused Guidance – Past paper walkthroughs, marking schemes, and common pitfalls

📌 Interactive Tools – Downloadable templates for ledgers, financial statements, and worksheets

🌍 Real-World Connections – How small businesses and global companies apply these principles

Accounting is the language of business – become fluent!

🔍 Start Your Journey to Accounting Excellence Today!

“A good accountant is a storyteller who speaks in numbers.”

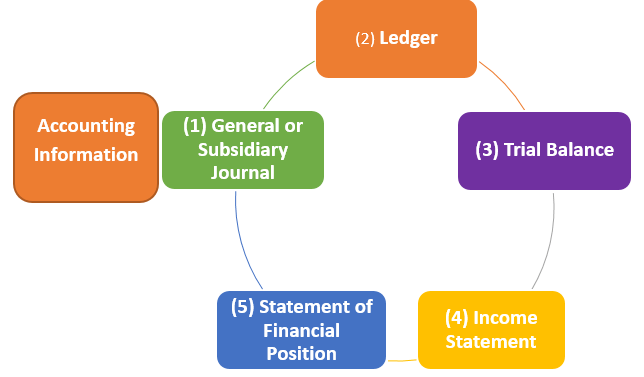

Double Entry Book-keeping is a method to record business transaction in which two aspects of transaction are recorded. These two aspects are receiving and giving. These two aspects are also called debit and credit & in all types of journals both sides must be equal. In each transaction at-least two accounts are used. In our course we shall directly record transactions into ledgers. Here rules for debit and credit are important to understand.

Cambridge IGCSE/O LEVEL Topic: 2 Sources and recording of data, Double Entry Book-keeping Read More »