What are the Functions and Qualities of Money? we are going to explore the fundamental roles and characteristics of money in this insightful blog post. Understand how money serves as a medium of exchange, a store of value, and a unit of account. Delve into its essential qualities like durability, divisibility, and acceptability that make it indispensable in modern economies. A must-read for anyone seeking clarity on one of the core concepts of macroeconomics. This topic is equally important for the students of economics across all the major Boards and Universities such as FBISE, BISERWP, BISELHR, MU, DU, PU, NCERT, CBSE & others & across all the business & finance disciplines.

Table of Contents

What are the Functions and Qualities of Money?

MONEY

For everyone, young or old, male or female, educated or not, rich or poor, intelligent or foolish, money has always been a fascinating term. On the one hand, various people have varied demands and preferences when it comes to material items. For example, a youngster may be interested in toys and chocolates; a student may desire books; a woman may be eager to purchase more makeup; a hungry person may want food; and a homeless person may dream of owning a home.

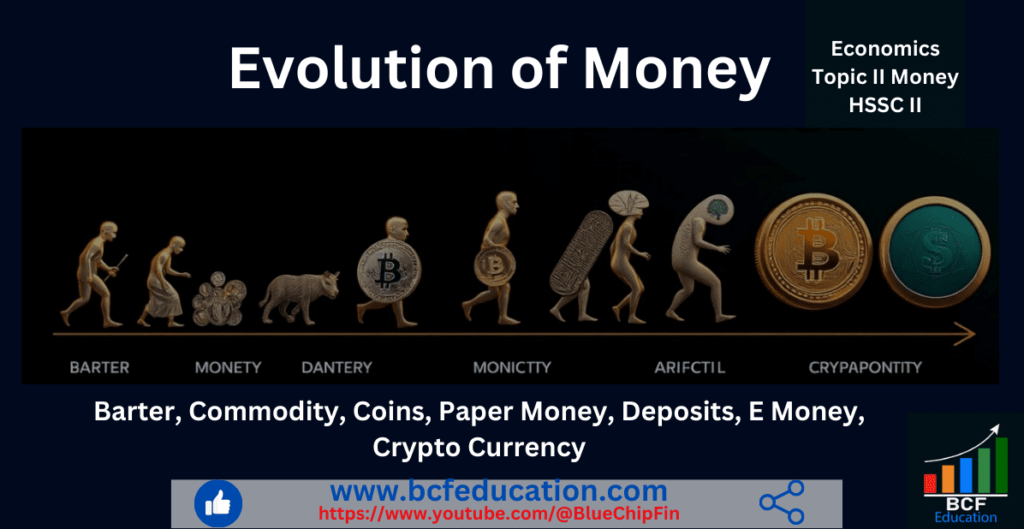

On the other hand, the desire to obtain money is typical because money is a medium of exchange goods and services. Each of them believes that possessing money will satisfy their material needs. Earliest use of money was occurred in Mesopotamia (Iraq) around 2500 BC

Definitions of Money

According to Walker “Money is what money does”.

According to Morgan“Money is anything that is widely used in payments of debts”.

According to Samuelson “Money is the modern medium of exchange and the standard unit in

which prices and debts are expressed.”

FUNCTIONS OF MONEY

Money is what money does. So to fully understand the nature of money, we have to consider the functions it performs. The important functions of money are the following:

1. Medium of Exchange

This is the first and the primary function of money. Money was invented to replace the difficult barter system and other inconvenient mediums for transactions. Money represents general purchasing power. For example, a person having cloth can sell it for money and then use the same amount to purchase any good he likes.

2. Measure of Value and Unit of Account

Money also serves as a standard measure of value. Monetary unit is used as a yardstick for measuring the relative values of different goods. In money economy, since all values are expressed in terms of money units, it becomes possible to show the wealth of a person or national income of a country as one figure.

3. Store of Value

Under barter system, it was so difficult to store goods and services as a wealth. Money has solved this problem and now we can store it easily. Now all the assets can be liquidate easily and we can store for a long time as a wealth. This stored money can be used for any purchases and at any time, as one likes. Moreover, no cost is involved in storing of money.

4. Standard of Deferred Payments

Today’s business heavily depends on credit so borrowing and lending is a common monetary and business activity so we use money to make payments at some future time. It also helps to compare the values of goods at different times. Money can perform this function so well but if the value of money remains stable.

5. Means of Transferring Value

Transfer of value is another important function performed by money. we can easily transfer the value of any moveable or immovable property from one place to another through liquidation. Money increased geographical mobility.

6. Medium of Government Payments

Government generates revenue through taxes, duties, fees etc. and pay salaries, pensions, payments. This process can be done easily with the help of money.

7. Technological Functions

With the help of money, now technology can be attained very easily, in result we are experiencing new technologies and experiencing massive output of goods with new innovations.

8. Trade and Mobility

Function of money is to facilitate the trade. Now even trade across the countries became so easy. Trade is done in terms of money which is convenient. At the same time mobility of labour goods also became easy because of wetting worth in terms of money.

9. Dynamic Functions

There are other functions of money dynamic in nature such as price level, interest rate deficit financing etc. All these functions are performed through money. Money is involved directly or indirectly in all these dynamic functions.

QUALITIES OF MONEY

History reveals that many items, such as paper, metals, grains, stones, and so forth, have been utilised as currency in various nations worldwide. But through trial and error, man has learnt that some things serve the purposes of money more effectively than others. The desirable qualities that a good money material should have are listed below.

1. General Acceptability

Most important feature of money is general acceptability which means that people should accept it without hesitation as a medium of exchange either material is precious or not.

2. Divisibility

Another important feature of money is easy divisibility which means that money material should be easily divisible into as smaller units, without losing its value. For example a cow cannot be divisible but paper currency can be divisible easily.

3. Portability

Money should be easy to transport and convenient to carry. This quality allows individuals to transfer it from one place to another without much effort or cost. Today e currency is more convenient way to transfer from one place to another. Paper money as well easy to transfer with respect to goods in barter system.

4. Recognizability

Good money should be easily recognizable. Material and features of money must be easily identified by the people as a money.

5.Storability

Material which cannot be stored for a long time cannot be considered as a good money such as grains, fruits etc. On the other hand metals such as silver, gold, and paper money can be stored for a long time and ideal for money.

6. Durability

Good money must be durable, it is useless if it is perishable or melted away in the pockets. Same as above fruits, grains are not durable but on the other hand metals such as silver, gold, and paper money are durable.

7. Homogeneity and Uniformity

All the units of money and their material must be of uniform or identical in quality, otherwise, it will lack general acceptability. Paper money is best for this purpose because paper money is homogenous.

8. Stability of Value

Good money must be stable in value. Intense fluctuation in the value of money such as inflation or deflation can lose the public confidence in money.

9. Malleability

Good money must be easy to make. Material of money should be selected with great care that it must be convertible in any desired shape. For example metals such as silver and gold and paper are easy choice because they can be given any shape and design.

10. Scarcity

Material which is used as money must be scarce because over printing or over use can lose the value of money. If paper money is printed in excess, it must lose the value such as in deficit financing.

11. Economy

Another feature of good money is that it must be cost efficient. If process of making money is costly, money will not be a good money. Paper money is best under the quality of economy.

Related Articles

Evolving different thoughts of Economics

2.1 Theory of Consumer Behaviour

2.2 Total Utility, Marginal Utility, Point of Satiety & Types of Utilities

2.3 The Law of Diminishing Marginal Utility DMU

2.4 The Law of Equal Marginal Utility EMU

3.1 Demand, Individual Demand, Aggregate Demand, Law of Demand

3.2 Change and Shift in Demand, Extension and Contraction in Demand, Rise and Fall in Demand

3.4 Point and Arc Elasticity of Demand