Understanding How to measure National Income? is a fundamental aspect of macroeconomics, essential for evaluating the economic health and performance of a country. This blog post explores the concept of national income, the significance of its measurement, and the key approaches used—namely the Income Method, Expenditure Method, and Production Method. Each method is explained with real-world examples to illustrate its application. Learn how these approaches contribute to policymaking, economic planning, and comparing economies globally. Perfect for economics students, researchers, and enthusiasts seeking to deepen their knowledge of macroeconomic principles!. This topic is equally important for the students of economics across all the major Boards and Universities such as FBISE, BISERWP, BISELHR, MU, DU, PU, NCERT, CBSE & others & across all the business & finance disciplines.

Table of Contents

How to measure National Income?

Introduction

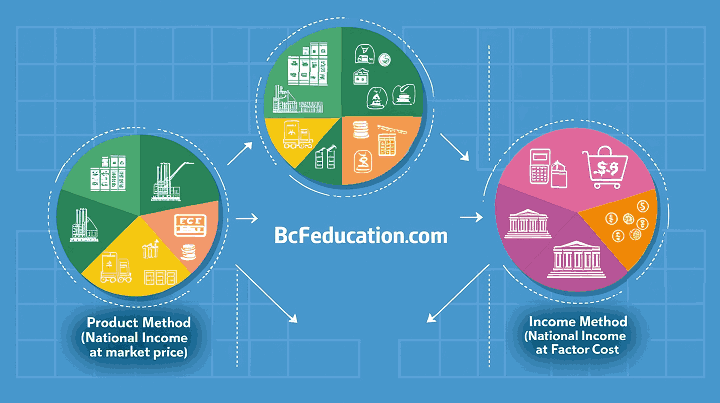

To measure national income is a difficult task because there are thousands of activities performed by households in a country and it is difficult to record sources of income precisely but we can

make good estimate of national income. Households spend their income in consumption, savings and to

pay taxes. There are three different methods to measure national income explained below:

- Product Method (National Income at Market Price)

- Income Method (National Income at Factor at Factor Cost)

- Expenditure Method

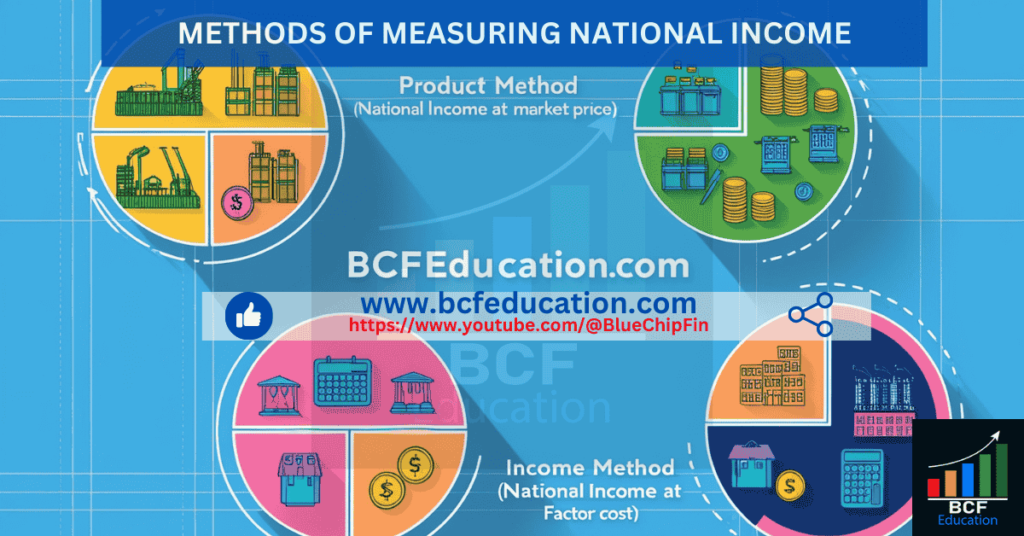

1. Product Method (National Income at Market Price)

Product method 1s also called National Income at Market Price. In this method, different steps are taken to calculate it.

- First of all, economy is distributed in different sectors such as, agriculture, cement, textile, fertilizer, minerals, sports etc.

- In second step, value of all final goods and services produced in a year of different sectors of economy is taken.

- In third step, net value of all goods and services is taken which means that value of production by the sector minus value of inputs taken from other sectors in order to produce final goods and services.

- In fourth step, foreign income is added in order to get Gross National Product GNP.

- In fifth step, depreciation allowance is subtracted in order to get Net National Product NNP or National Income.

This method helps to identify the relative progress or importance of the sector. Example of the determination of National Income with the help of Product method is given below:

| Sectors of the Economy | Net Value Added in Billions |

| Agriculture (Livestock, Poultry, forestry, fruits, dairy items) | 80 |

| Manufacturing | 45 |

| Transportation | 30 |

| Trade | 30 |

| Construction | 20 |

| Minerals | 50 |

| Cement | 60 |

| Iron | 40 |

| Services (Health, Education, Public Administration, Defense etc. | 30 |

| National Income | 385 |

Precautions

1. Double Counting

Double counting must be avoided while calculating National Income. There are two ways to avoid this, first option is that we only take the final value of goods and services such as final value of the cement and iron while ignoring inputs value. Second way is that we take the value added of each step of the product.

2. Subtract Depreciation Allowance

Depreciation allowance which is wear and tear value must be subtracted from the final value of goods and services.

3. Subtract indirect Taxes

Indirect taxes such as sales tax, excise duty must be subtracted from the final value of goods and services.

4. Adding Subsidies

Subsidies are monetary relaxations by the government to the general public in order to buy goods and services at cheaper price must be added to the National Income.

5. Unpaid services

Services those are performed as a hobby must be subtracted while calculating National Income.

2. Income Method (National Income at Factor Cost)

This method is derived from the income side as sum of all the incomes received by the households in a country within one year. Under this method of measuring national income, it calculates the total income earned by the factors of production (land, labor, capital and organization or entrepreneurship) within a country during a specific period, usually a year.

Incomes of the factors of production are rent against land, wages and salaries against labour, interest against capital and profit against organization or entrepreneurship. This method adds up all the incomes earned by individuals and businesses in the economy. Factor incomes are given in detail below:

1. Wages and Salaries: This includes all compensation to employees, such as wages, salaries, bonuses, and social security contributions.

2. Rent: This is the income earned from renting land and other properties.

3. Interest: This includes income received by capital owners, such as interest earned on bank deposits, bonds, and other investments.

4. Profits: This encompasses the earnings of businesses after deducting their costs. It includes corporate profits, dividends, and retained earnings.

5. Mixed Income: This refers to the income earned by self-employed individuals and unincorporated businesses, which can be a mix of wages, rent, interest, and profits.

6. Taxes less Subsidies on Production and Imports: This includes indirect taxes (like sales tax, VAT) minus subsidies given by the government.

The formula for the income method is:

National Income (NI)=Wages and Salaries + Rent + Interest + Profits + Mixed Income + (Taxes —Subsidies)

All the productive activities performed at home are excluded because we cannot measure these activities such as cooking meals by women at home etc. Transfer payments are also excluded from national income because these payments are not earned against productive activities such as zakat, scholarships, donations etc.

This method is also helpful in order to know the incomes earned by different groups of the country such as businessmen, landlords, capitalists, workers etc.

Precautions

Transfer Payments Transfer payments such as zakat, donations, scholarships must be excluded from the national income because these are not earned against any productive source.

Incomes from Illegal sources

Incomes generated through any illegal source must be ignored such as smuggling, bribery, theft etc.

3. Expenditure Method

Expenditure method is another way to calculate National Income in which all the expenditures done by the households and government within one year are added in order to know the National Income. Each unit of money spend as an expenditure is income for the other one at the same time that is why this method can also be used to measure the National Income. Formula for the National Income under expenditure method is given below:

Y=C+I+G+(X—M)

Where Y stands for income;

C stands for private consumption of households on goods and services for living. Expenditure on new houses are excluded and added to investment.

I stand for Gross domestic investments such as buying machinery, houses & buildings, vehicles etc.

G stands for Government current expenditures on defense, health, education, police etc.

X stands for exports and M stands for imports.

Here imports must be excluded because imported goods are not produced within the country.

Precautions

Double counting must be avoided while calculating National Income. There are two ways to avoid this, first option is that we only take the final value of goods and services such as final value of the cement and iron while ignoring inputs value. Second way is that we take the value added of each step of the product.

Second hand Goods

Second hand goods are not produced in current year and they included in income in the year in which they are produced so they must be excluded.

My brother suggested I might like this website He was totally right This post actually made my day You cannt imagine just how much time I had spent for this information Thanks